This update is from Sosland Publishing Co.’s weekly Sweetener Report. This update is from Sosland Publishing’s Sweetener Report. For more information and subscription details, CLICK HERE.

Insight Focus

- Beet facilities report no major breakdowns or delays.

- Above-average temperatures may start to warm beet piles.

- Cash sugar prices are steady despite sharply lower futures prices.

Bulk refined cash sugar prices were steady to slightly weaker this week amid seasonally slow trading and sharply lower raw sugar futures prices.

US bulk refined beet sugar offers for spot delivery were 59¢ to 60¢ a lb f.o.b. through Dec. 31, steady to 2¢ lower, and for 2024 were 57¢ to 59¢ a lb f.o.b. Midwest, unchanged. Traders indicated beet sugar could be purchased for 2024 below list in the mid-50s depending on volume and other factors.

Beet facilities were running strong with no reports of major breakdowns or delays. Some operations were reporting daily and weekly record outputs. One concern was above-average temperatures across the Red River Valley and Michigan that were starting to warm sugar beet piles. Beet processors remained in the market, but many weren’t actively selling as most of the current year’s business was booked. Also, while supplies still were available, there wasn’t enough to pressure pricing for 2024, and processors were treading water until the next marketing year’s selling cycle begins in earnest.

List prices for US cane sugar were steady, but some beet sugar sellers noted instances of cane sugar prices from some domestic refiners narrowing to a more competitive price range to beet sugar. Ideas were US sugar cane production from drought areas was better-than-expected and was being added to large raw inventories carried over from the prior year’s prolific sugar cane crop. Another thought was the additional supply of imported cane sugar may be contributing to a softer tone in the market overall, as was possible weakness in deliveries.

Deliveries of contracted sugar continued to slow at mostly seasonal levels. There were reports of even slower deliveries of bulk refined sugar, attributed to healthy inventories from earlier double-booking when supply availability was unknown. Deliveries to retailers remained steady.

Spot refined cane sugar was offered at 68¢ a lb nationwide through Dec. 31 and was offered for calendar 2024 at 63¢ a lb f.o.b. Northeast and West Coast and at 59¢ to 61¢ a lb f.o.b. Gulf and Southeast.

Sales for 2024-25 were occurring, but most refiners and processors — as well as buyers — were awaiting the International Sweetener Colloquium in late February to consider their options for contracting.

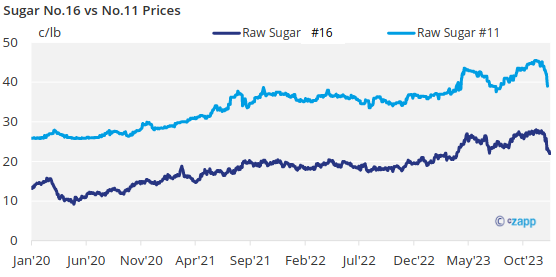

Nearby No. 11 (world) and No. 16 (domestic) raw sugar futures have plunged more than 5¢ a lb in the past couple weeks. Record-high production in Brazil and a policy change away from ethanol in India relieved nearby supply tightness and prompted fund liquidation, with pressure spilling over to the No. 16 market that had added pressure from a recent reallocation of 2023-24 raw sugar tariff-rate quota imports.

Corn sweetener contracting for 2024 was expected to be complete ahead of the yearend holidays as prices were flat to slightly lower from 2023 contracted levels.