This update is from Sosland Publishing Co.’s weekly Sweetener Report. This update is from Sosland Publishing’s Sweetener Report. For more information and subscription details, CLICK HERE.

Insight Focus

- Drought in Louisiana and Mexico have compromised the quality of the respective sugar beet crops.

- But in Red River Valley, sugar content is above expectations.

- Sugar beet harvested in the largest four states as of Oct. 8 was 10 percentage points behind the same period last year.

The sugar beet harvest gained momentum in some areas during the week ended Oct. 13, while bulk refined sugar prices were unchanged with a firm tone. The US Department of Agriculture reduced its estimate of 2022-23 sugar supplies and cut its forecast of 2023-24 supplies, while also reducing deliveries of sugar for food use for both periods.

Sugar beets in the four largest producing states were an aggregate 21% harvested as of Oct. 8, up just six percentage points from a week earlier and well behind 31% a year ago and 36% as the 2018-22 average for the date, the USDA said in its latest Crop Progress report. Harvesting was slowed by warm or wet weather, but full operations resumed in the Red River Valley where sugar content was said to be above expectations. The Michigan harvest was delayed as growers gave beets more time to deposit sugar.

Drought in Louisiana was dire with 100% of the crop in exceptional drought as of Oct. 10, the highest rating in the US Drought Monitor, with the crop rated 22% good, 43% fair and 35% poor to very poor, near the lowest ratings in more than a decade. The cane harvest was about a week behind the average pace.

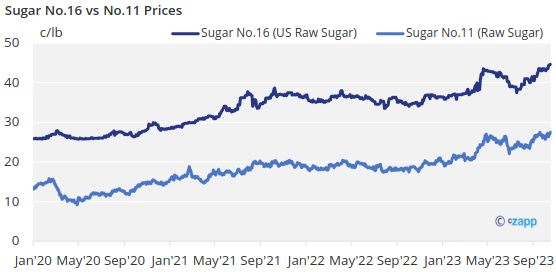

Bulk refined cane and beet sugar prices were unchanged. Adjustments may come in a few weeks as more is known about the cane and beet crops and as a couple of beet processors re-enter the market after being out most of the summer. There should be additional beet sugar supplies on the market by early November. Whether that is enough to offset losses in Louisiana and affect prices at least briefly remains to be seen.

Both beet and refined cane sugar prices varied, in some cases widely, due in part to pricing schemes that varied between the calendar year and the new marketing year that began Oct. 1. In general, prices maintained a firm undertone. Also, a consideration was forecast lower production in Mexico due to drought, which may restrict sugar exports to the US.

The USDA in its Oct. 12 World Agricultural Supply and Demand Estimates (WASDE) report forecast Mexico’s 2023-24 sugar production at 5,575,000 tonnes, actual weight, down 225,000 tonnes, or 3.9%, from its September projection as “Mexico is currently experiencing widespread drought conditions,” the USDA said.

Trade sources indicated mixed sugar delivery levels for September and October. After beet sugar deliveries ran below expectations for much of the summer, some continued to indicate deliveries were below expectations going into the fall. But others said deliveries were about as expected with strong shipments to some users offsetting weaker deliveries to others. Most expect seasonally strong deliveries in November.

The USDA in its WASDE report lowered from September its estimated deliveries of sugar for human use in 2022-23 by 25,000 tons and lowered its forecast for 2023-24 by the same amount.

The USDA forecast 2023-24 US sugar production at 8,969,000 tons, up 12,000 tons from September. Total sugar imports were forecast at 3,277,000 tons, up 13,099 tons from September. Total US sugar supply in 2023-24 was forecast at 14,222,000 tons, down 182,212 tons from September (due mainly to lower beginning stocks). Ending stocks in 2023-24 were forecast at 1,557,000 tons, down 9%, from September and down 21%, from 2022-23. The ending stocks-to-use ratio was forecast at 12.3%, down from 13.5% in September.

For 2022-23, total sugar production was estimated at 9,237,000 tons, down 24,000 tons due to a like reduction in output in Louisiana with delayed cane harvest pushing the production into 2023-24. Total imports were estimated at 3,584,000 tons, down 4.1% from September, including imports from Mexico at 1,156,000 tons, down 63,000 tons. Total supply in 2022-23 was estimated at 14,641,000 tons, down 178,000 tons. Ending stocks were estimated at 1,977,000 tons, down 8% from September, with the ending stocks-to-use ratio at 15.6%, down from 17.1%.

The USDA published in the Oct. 13 Federal Register the fiscal year 2024 (2023-24 marketing year) overall sugar marketing allotment (OAQ), cane and beet sugar marketing allotments and company allocations. The USDA established the 2023-24 OAQ at 10,667,500 short tons, raw value, equal to 85% of estimated sugar deliveries for human consumption in the September WASDE report, up 21,230 tons from the initial 2022-23 OAQ, which was later raised to 10,710,000 tons.

Annual contracting of corn sweeteners for 2024 was progressing slowly. Another buyer entered the market with offers slightly above 2023 contracted levels. Users have balked at the initial offers, expecting lower prices in 2024 due to higher corn supplies and lower corn prices.