This update is from Sosland Publishing Co.’s weekly Sweetener Report. This update is from Sosland Publishing’s Sweetener Report. For more information and subscription details, CLICK HERE.

Insight Focus

- Price negotiations for annual 2024 corn sweetener product contracts have begun.

- Numerous sugar buyers are not yet fully covered for 2023-2024.

- Both beet processors and cane refiners are holding prices.

Focus during the week ended on 1 September on the worsening drought in Louisiana and the early stages of sugar beet harvest in the Red River Valley. Spot and forward cash sugar prices were unchanged.

The good-to-excellent sugar cane rating in Louisiana fell to 35% (34% good, 1% excellent) as of Aug. 27, down from 38% a week earlier, 63% at the same time last year and the lowest in at least a decade. Cane harvest typically begins in late September in Louisiana so time was running short for beneficial rainfall. Some analysts have removed as much as 200,000 tonnes from their 2023-2024 outlook for Louisiana sugar production.

With the exception of Michigan, sugar beet crops mostly held their own or improved as harvest began or will soon be underway. The good-to-excellent rating in Michigan fell to 40% as of 27 August, down sharply from 51% a week earlier and 64% at the same time last year. But ratings moved higher from a week earlier in Minnesota, North Dakota, Idaho, Colorado, Wyoming and Oregon and were mixed compared with a year ago. The beet crop was 4% harvested in North Dakota. Harvest in other areas was set to begin from 5 September to 1 October.

Sugar sales continued at a slow pace for 2023-2024 after most business was concluded earlier than normal with a rush in March. Numerous buyers are not yet fully covered for 2023-2024, with some small and mid-size users said to be totally uncovered. Most of those buyers will have an opportunity to buy beet sugar when (and if) beet processors come back into the market in October, as they typically do after they are certain about the current beet crop. At least two processors have been out of the market for some time, and it remains to be seen if one or both re-enters in October. Two other major beet sugar sellers have remained in the market throughout the summer. The risk of waiting to buy sugar may be increasing due to rising futures prices, tightening global sugar supplies and the deteriorating Louisiana crop.

Both beet processors and cane refiners are holding prices steady in the spot market and for 2023-2024. While spot beet sugar supplies are available due to slow deliveries for most beet sugar sellers, they have been reluctant to lower prices before the 2023 crop is harvested.

Hurricane Idalia missed sugar cane growing areas and cane refineries in Florida.

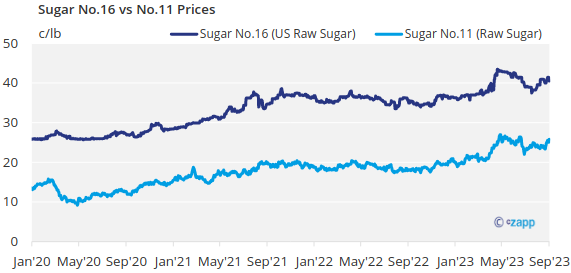

World and domestic raw sugar futures have advanced on tightening global and domestic raw sugar supplies. Added support came from 12-year highs in London white sugar futures.

Negotiations were beginning for annual 2024 contracting of corn sweetener products, with early talk of lower prices for 42% high-fructose corn syrup and flat prices for other products.