This update is from Sosland Publishing Co.’s weekly Sweetener Report. This update is from Sosland Publishing’s Sweetener Report. For more information and subscription details, CLICK HERE.

Insight Focus

- Beet planting essentially finished (Montana excepted).

- Beet emergence is mixed compared to last year.

- Most 2024 sugar sales are complete.

The cash sugar market was quiet in the week ended June 2. Sales for 2024 continued at a slow pace with most business already completed. Sugar beet planting was essentially finished. Cash prices were unchanged.

US Department of Agriculture state offices said the sugar beet harvest was basically complete in all reporting states except Montana as of May 28. Emergence was mixed compared with a year ago. Additional acres were being planted in the Red River Valley to offset possible lost production from later than desired planting, but total US beet acreage still will be down from 2022. Beet crops, as well as Louisiana’s cane crop, were off to a good start for the season.

Sales for next year were slow with most business completed a few weeks ago. A number of buyers were uncovered, or partially so, hoping good beet and cane crops may push prices lower in the coming months. It’s not uncommon for beet sugar prices to dip briefly in October once harvest begins. One beet processor was out of the market until October.

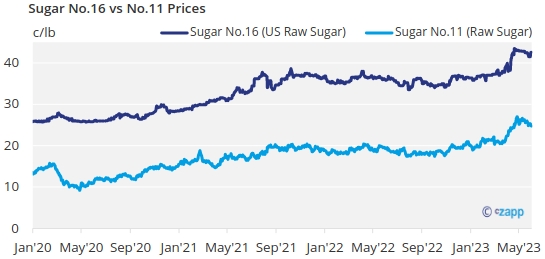

Bulk refined beet and cane sugar prices for 2024 were unchanged with no indication of imminent price changes. Spot sugar prices also were unchanged. Above-quota (high-tier) importing of sugar continued with prices still favorable compared with refined cane sugar prices.

Mixed signals are forming this year for the July-September quarter, which typically is the tightest supply period of the year as beet processors ship out stored sugar, Mexico’s shipments wind down seasonally, and US cane refiners fill the gap. Most expect Mexico will fall short of its export forecasts as production there is ending the season below expectations.

But domestic beet processors may well have some supply to sell after being out of the spot market for several months. Most have indicated slower-than-expected contract performance. One distributor said he had been contacted by several processors asking if he wanted to buy sugar. There were indications one processor offered to allow buyers to roll undelivered supply into the October-December quarter or give up the supply for the processor to offer on the spot market. Processors weren’t expected to officially re-enter the spot market, but most have some spot supply to move.

Deliveries still could pick up as the summer progresses, and a couple sellers noted improved shipments in the last half of May. But if Mexico falls short of its forecast shipments to the United States, there could be an eager market for any extra domestic supply, which in turn could limit hoped-for price weakness.

The domestic corn sweetener market was quiet, but distributors noted slow draw against contracts by users of 42% high-fructose corn syrup and of dextrose. Deliveries of regular corn syrup (glucose) and 55% HFCS (used in beverages) were steady. Increased demand for HFCS in Mexico to replace tight supplies of high-priced sugar there may provide a market for extra supply in the United States.