This update is from Sosland Publishing Co.’s weekly Sweetener Report. This update is from Sosland Publishing’s Sweetener Report. For more information and subscription details, CLICK HERE.

Insight Focus

- Spot and 2024 sugar prices unchanged.

- Beet planting nearing completion in most areas albeit later than hoped.

- Processors report slower-than-expected deliveries of contracted sugar.

Sugar beet planting was expected to be near completion in most key areas by the end of the week. Sales were steady but slow. Cash sugar prices were unchanged.

The US Department of Agriculture in its Crop Progress report said sugar beets in the four largest beet-growing states were 79% planted as of May 14, jumping from 41% a week earlier and modestly ahead of 72% as the 2018-22 average for the date. The increase mainly was the result of strong progress in Minnesota (75% on May 14 versus 23% a week earlier) and in North Dakota (60% compared with 1% the prior week). Growers in the Red River Valley were expected to be “98% to 99%” finished with planting by week’s end.

Planting was later than hoped, increasing the need for ideal weather during the growing season and reducing potential for early harvest.

The sugar cane crop in Louisiana was in outstanding condition as of May 14.

The USDA in its May 12 World Agricultural Supply and Demand Estimates report lowered forecast 2022-23 total sugar supply by 0.6% from April and boosted its delivery forecast by 0.6%, resulting in ending stocks of 1,734,000 tons, down 163,000 tons, or 8.6%, and ending stocks-to-use at 13.5%, the low end of the USDA’s typical range for the ratio.

Initial 2023-24 sugar production was projected at 9,225,000 tons, down 0.6% from 2022-23 with beet sugar down 3.8% but cane sugar up 3.3% and record high.

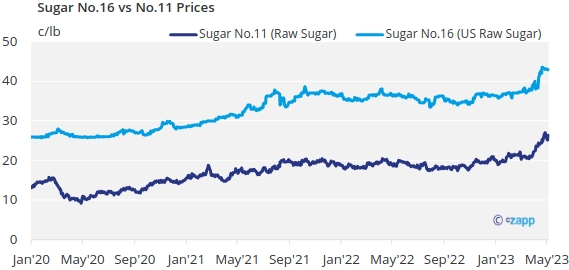

The cash market was quiet. Some beet and cane sugar sales for 2024 continued, but most buyers had put on adequate coverage some weeks ago and most beet processors had sold as much sugar as they were comfortable selling for the date. One processor remained out of the market until harvest begins in October. Some smaller and mid-size buyers still needed 2024 coverage and were hoping for a price break, but most traders saw little potential for a sizable, if any, break any time soon. Some surmised 2024 prices could creep closer to spot levels as the year goes on in part because of tight world supplies and strong global raw sugar values. On the other hand, some processors may offer a bit more sugar once beet planting is completed, which could limit increases.

Spot and 2024 sugar prices were unchanged, in part because of light volume and no momentum to move values up or down.

A number of processors continued to report slower-than-expected deliveries of contracted sugar in the current year. While those sellers were not expected to officially re-enter the spot market, they will have small amounts of sugar available, which may be needed in August-September if less new-crop sugar is available due to late beet harvest.

The domestic corn sweetener market was quiet. The USDA raised its 2022-23 forecast for use of high-fructose corn syrup in Mexico to offset tight, record-high priced sugar. Mexico imports most of its HFCS from the United States.