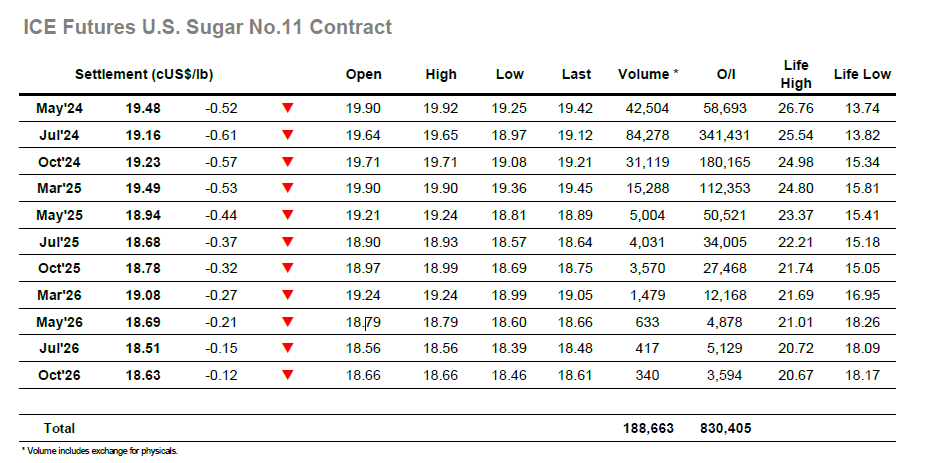

The market picked up where it left off as last night’s late decline extended down to 19.46 before the market looked to dig in and find some support. This extended through a good proportion of the morning but as the buying waned, so the market started to come under renewed pressure with the lack of progress this week seemingly encouraging fresh spec selling back into the market. Scale buying was limited and with little other supportive interest for the market the Jul’24 price eroded into the 19.20’s before the US morning got properly underway. The arrival of additional specs on drew in more selling and another, more aggressive, slide followed, this time sending the price down beneath last week’s 19.08 mark to record new lows for the year at 18.97 before bottoming out. With the environment still thin to both side the market proceeded to bounce sharply also with the recovery extending back up by 0.60 points to 19.57 before running out of steam and retreating towards the lower echelons of the range. Additional selling crept in ahead of the close which led Jul’24 to settle at 19.16, a weaker technical close which raises new questions as to whether the market has yet reached a bottom.

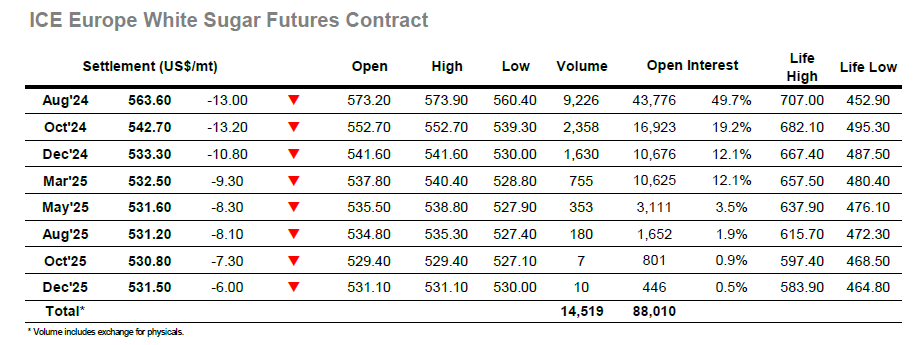

There was a lower opening today which saw Aug’24 trading down to $568.50 initially, and though the price then looked to stabilise the market was lacking some of the enthusiasm of recent sessions. Consolidation took place through much of the morning but by noon the market had started to track lower again with new session lows being seen to fill much of the gap left earlier this week for the intra-day chart. One area which was not seeing any change was the white premium where Aug/Jul’24 was maintaining the recent recovery and holding in the low $140.00’s, while nearby spreads were also well supported and maintaining the structure across the board. Heavier selling / liquidation into the early afternoon pushed the market all the way back to $560.40 however the move halted when still several dollars above last weeks lows and a covering rally incredibly pulled the price all the way back to a session high $573.90. Underlying the current lack of direction being felt in the market this move similarly ran out of momentum and so prices returned to the centre of the days range during the later stages. The recovery was not maintained and a pre-close burst of selling sent the market back down the range once again, leaving Aug’24 to settle at $563.60 and bringing the yearly low ($555.80) back into focus.