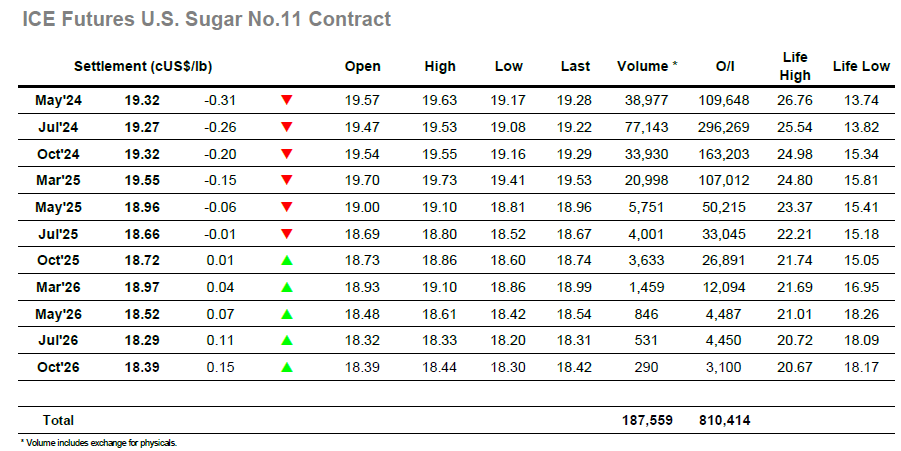

A softer opening was initially gathered up and Jul’24 briefly printed back to unchanged levels, though this was a mere pause in the recent trend with prices soon beginning to slip again. The morning losses only extended down to 19.23 which meant that prices were still holding above yesterdays lows, however additional pressure followed during the early afternoon to send the market lower still. There remains scale buying beneath as consumers look to lock in against the best pricing opportunity since 2022, and this limited the drop to 19.08 before some short covering kicked in and the market mounted a small recovery. The pattern of the bounce followed recent efforts with the movements petering out in quick time once the smaller trader activity concluded and the market then settled back down to flit within the lower part of the range. The weight of selling at the top of the board meant that spreads were again under pressure during the day, with lows recorded for May/Jul’24 at 0.02 points and Jul/Oct’24 at -0.07 points while the largest moves were being seen against long dated prompts with 2025 and 2026 positions trading higher into the afternoon in contrast to the spot. The market showed less desire to break from the range as the afternoon moved forward, and a calmer period concluded with a close for Jul’24 at 19.32 which leaves the market still struggling to find any reason to turn.

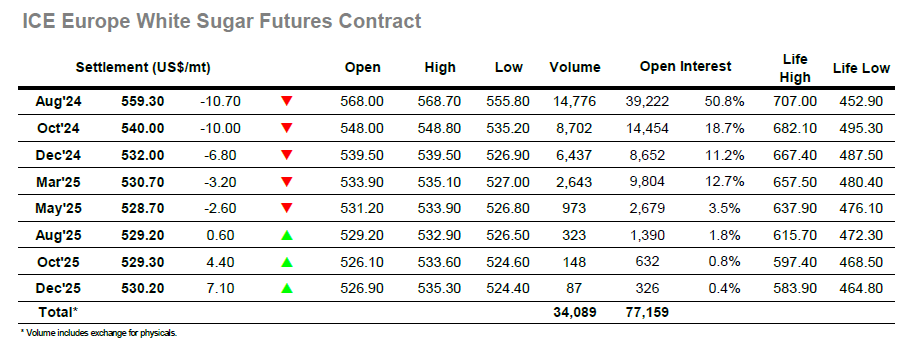

There was no respite for the market as Aug’24 commenced the day a couple of dollars lower before continuing to push through scale buying and record another set of new lows. Only having reached $560.80 did the market look to hold, however with only short covering for support the downward path was renewed before the morning concluded. Despite the plunging value there was some contrary movement taking place for the Aug/Oct’24 spread where some unusually aggressive buying extended the differential out to $24.60 at one stage, though once concluded the gains started to erode. With the double bottom level at $565.60 long forgotten the market continued its slide to a $555.80 low early in the afternoon before finding some respite against the usual array of short covering. Volumes were again good with sellers having to push through scale pricing orders while there was continued steady spread interest. White premiums too added to the activity with the May delivery raising some concerns and sellers being found as they lowered targets against previous orders. Having moved away from the lows the afternoon played out in a calmer way, continuing to flirt with the lows but finding sufficient support to tick along within a band. Aug/Oct’24 was back around the $19 area late on with the earlier rally wiped out, while the white premiums continued to struggle leaving Aug/Jul’24 at $134.50 and values down the board also weaker. MOC selling sent Aug’24 out at $559.30 to complete another poor technical session.