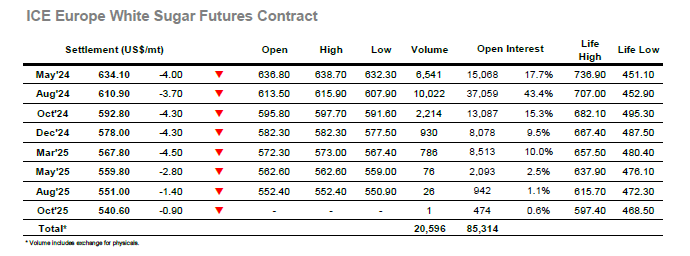

The “bullish” bubble has well and truly burst for the specs with the start of today’s session seeing them retreat to leave the market edging along quietly. Without their buying efforts May’24 held a small way beneath overnight levels, making a low at 21.46 on support from some light consumer scales but with little other activity of note taking place. The afternoon brought with it the heavier index rolling to boost volumes, and the flat price in turn picked up some additional day trader interest which allowed the market to push the edges for the range, first down to 21.38 and then quickly upward to 21.66. Further efforts saw a high recorded at 21.71 but as ever this was followed by position squaring and so values retreated through the range. May/Jul’24 volume made up more than 50% of the nearby activity as the spread held comfortably in the lower 0.30’s, and that aside there remained little to stoke any interest. May’24 sat calmly in the upper 21.40’s as the close neared and a slow session concluded with settlement at 21.49 and May/Jul’24 back out to 0.36 points.

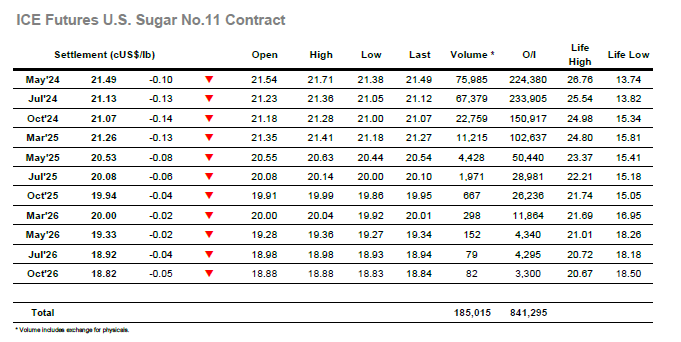

Withy less that one week until the May’24 contract expires it seems that most traders are well aligned as to their intentions with the market remaining incredibly calm. Morning movements were a little lower with the recently robust nearby white premium values giving back a couple of dollars, but that aside there was really very little activity taking place. May/Aug’24 was trading in a similar band to recent sessions and found support at $22.00 as it dipped, while the flat price held a narrow band. Moving into the afternoon there was some spec selling appearing for Aug’24 which sent the price down to $607.90, however as the market turned so the value was able to accelerate back into the teens with very little opposition being met. Though the sentiment for the whites has remained decent there has been a noticeable tailing off from the US specs with the No.11 decline holding the whites down, and this led us back into the range during the later afternoon on lower volume with the day petering out slowly. Settlement was reached at $634.10 for May’24 and $610.90 for Aug’24, while the Aug/Jul’24 arbitrage was marginally lower at $145.00.