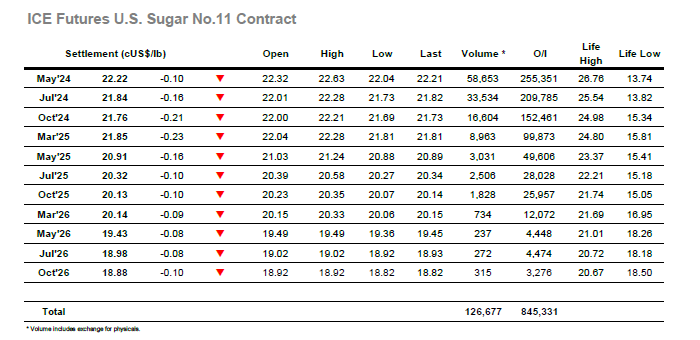

Initial weakness was gathered up, and while there was little physical interest due to the relatively lofty levels being seen currently the market did embark upon a higher path. Gains were steady through the morning though in part that was due to the strength of the white’s market pulling us along, and with sufficient activity from day traders the market was able to build back to 22.63 early in the afternoon. Front month spreads were only mildly firmer on the recovery, and with the shadow of yesterday’s Indian headlines still hanging over proceedings the lack of any trade interest alongside the day traders was creating a sense of fatigue. Long liquidation duly followed and set prices back down into the range, however rather than consolidate the market then encountered a second, more aggressive burst of liquidation which caused a collapse through the morning lows and placed May’24 back towards 22c. It was only here that the market looked to hold, and prices sat near to 22.10 for a period. There was a hint of recovery as we progressed into the final hour of trading and some defensive interest from longs ensured that prices remained clear of the lows to leave May’24 settling at 22.22.

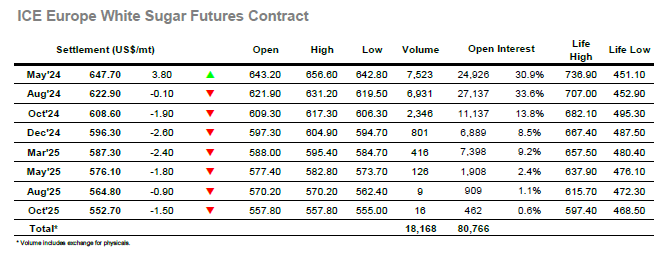

An unchanged opening soon attracted buying back to the environment with both May’24 and Aug’24 looking to push ahead and work back up through the range to retrace losses. With little scale selling in place May’24 steadily worked back into the lower $650’s by mid-morning, providing the basis from which the market could try to continue building. Another round of buying led the front month to a high at $656.60 as the US morning got underway, however there was to be no continuation of the push. No.11 had been a passenger on this rally with the white premium values stretching back out to $160 for May/May’24 and $140 for Aug/Jul’24, but with the necessary buying failing to arrive to No.11 its correction now became the driver and pulled the whites prices back down. Efforts to stem the decline were fleeting, and despite the continuing strength of the arbitrage the market sank to see only May’24 remain in credit reaching the final couple of hours while the rest of the board was trading at new daily lows. The market did look to stabilise a touch through the final hour and May’24 ended the day at $647.70, though Aug’24 was not so buoyant at $622.90. White premiums strengthened through the final stages to close at $158.00 while Aug/Jul’24 was valued at $141.40.