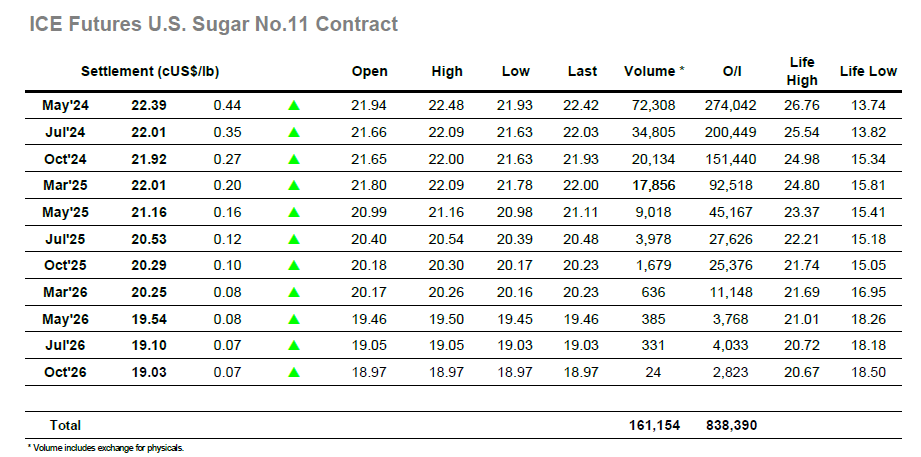

The session began positively with the latest nudge up through 22c against mixed buying, though having risen to 22.14 there was a pause in the progress and prices retreated to sit on top of the 22.00 mark. This provided a basis from which to look upwards again during the late morning and on this occasion the market gathered some additional spec buying to enable values to ascend into the 22.20’s and be eyeing up the recent highs at 22.35. Nothing is ever simple in the current market and so a period was spent consolidating the highs before making the move upward, though it proved to be successful with some better buying coming in to take the May’24 contract into the lower 22.40’s and then on to a new monthly high at 22.48. The move was being driven in the main by front month spec buying, emphasised by a solid widening of the May/Jul’24 spread to 0.41 points intra-day, and with the longs happy to hold positions there was consolidation at the upper part of the range. Additional progress was not possible, in part due to some heavier scale selling than has been seen in a while, and so a degree of position squaring / profit taking kicked in ahead of the close. MOC buying then followed to pick things back up, resulting in a May’24 settlement price at 22.39 that leaves the market in a solid technical position as we move forward.

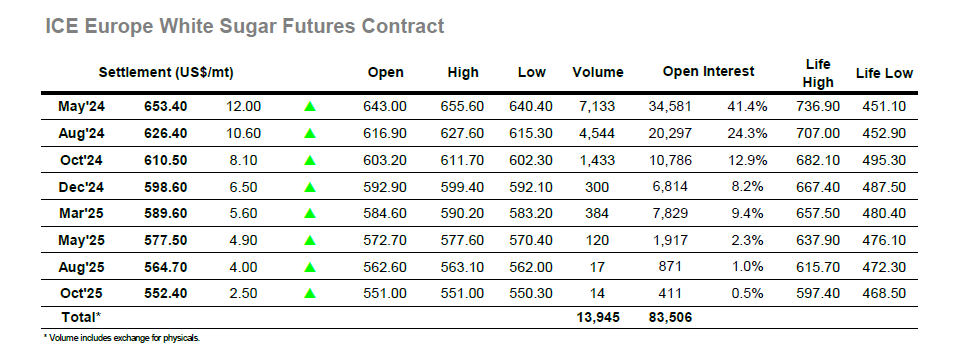

There has been relentless strength from the nearby whites contracts over recent sessions and this pattern was being maintained as a mixed opening provided the basis for another push upward. The rally initially stalled around recent highs and a drift back to the range followed, though by late morning there was some fresh buying interest emerging and the market was able to punch ahead into fresh ground. This progress saw May’24 above $650.00 before stalling against profit taking, but given the technical strength there was no real let up in the desire from spec buyers and we were soon moving higher still. It wasn’t just the flat price reaping the benefits of this movement as again we saw both nearby spread values and the white premium strengthening. As May’24 moved to an eventual high at $655.60 we saw May/Aug’24 reach $28.80 and Aug/Oct’24 trade to $16.00, and this left the market positioned very strongly as the end of the day approached. There was a degree of profit taking ahead of the call though prices remained solid to end the day at $653.40 with the next targets being the former highs at $662.80 and $670.00. This strong close maintained the white premium strength, May/May’24 closing at $159.80 and Aug/Jul’24 springing up to $141.00.