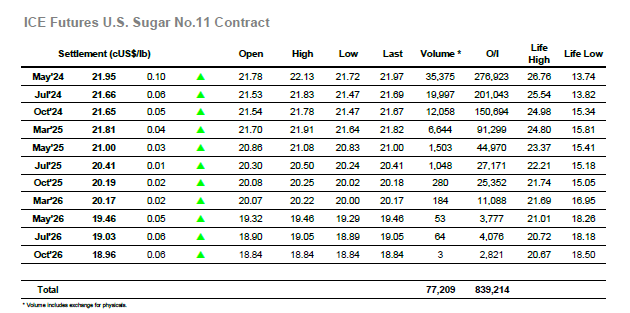

A marginally lower start for May’24 was soon gathered up as early buying proceeded to take the price quickly back toward to the 22.00 area. Fridays COT report showed a minor reduction of the net spec long to 14,696 lots (-3,642 lots) though action over the subsequent three sessions suggests this number is now likely to be slightly higher and so providing reason for specs to defend positions and continue trying to push higher. Ther usual efforts from small specs / day traders served to take the market up to 22.13 as the morning progressed, however with news still lacking and the market continually struggling to build above 22.00 the volumes were providing light and a retreat into the range proved inevitable. There was no fresh interest from the US and so the market became stuck within the existing range through the afternoon, swinging on day trader jobbing but seeing little other interest. There was some positive tone being set by the May’24 spreads which were all firmer, with May/Jul’24 extending out to 0.30 points as the end of the day approached. The slow conditions meant that most traders welcomed the close, and when it arrived there were some swings around the range as we reached a May’24 settlement price at 21.95.

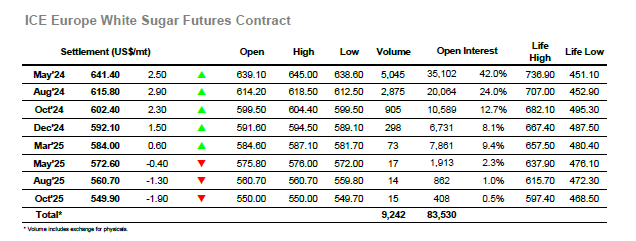

London whites have been on a steady path higher since seeing lows at $590.00 on 5th March, and May’24 continued the trend with more early gains that saw the price rise to $642.90, more than $50 above these monthly lows. This was still shy of Fridays recent highs and through an otherwise quiet morning the specs set off in pursuit of the $645.50 mark, though by noon they were still 0.50c shy of this mark as scale selling thwarted their efforts. Despite this the recent white premium squeeze was continuing along with our gains outstripping those of No.11 and the May/May’24 value widening out beyond $158.00. The flat price stalled, and some corrective action followed against position squaring, and while this did not damage the current structure it did serve to confine prices to the range through the afternoon. Half-hearted efforts to bring the market back upward lacked any size, while the dips found sufficient support around unchanged levels to ensure that existing parameters were maintained. All was calm ahead of the close, though the call saw a burst of defensive buying then appear to push the price back up by a few dollars and cover the same range seen across the previous few hours in a matter of moments. This left May’24 settling at $641.40 and the May/Aug’24 at $25.60, while the premium continues to show strongly at $157.50.