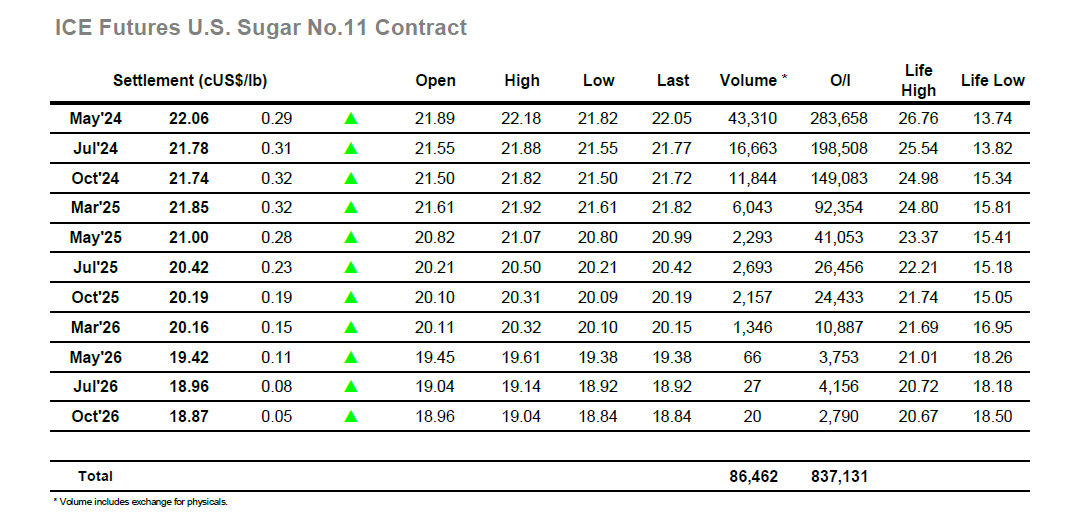

A jump to 21.99 on the opening i8mmediately showed the intent of smaller specs to try and build upon the sharp bounce back through the range, and though the progress initially stalled at 22.04 the market remained positive in the 21.90’s as the morning progressed. This provided a solid basis for a more aggressive push upward to be made once the US specs had entered the fray, and the market duly saw a push to 22.13 though then stalled as greater scale selling began to emerge ahead of the recent highs. Corrective action back to the 21.80’s followed though the market was still finding sufficient support to hold above the morning lows, leaving the overnight gap for the intra-day chart in place. In contrast to the net gains for the flat price there was some contraction now seen for the spreads, with May/Jul’24 into 0.27 points and Jul/Oct’24 off to 0.01 point, a contrarian signal which suggests a lack of confidence in continuing beyond the top of the range. This did not deter the spec buyers from pushing on again during the final couple of hours with their efforts taking the market to an eventual high at 22.18 ahead of the close following some consistent effort in the teens. End of day position squaring meant a settlement at 22.06, still positive but with work still to do if we are to see a challenge of the recent 22.35 high mark.

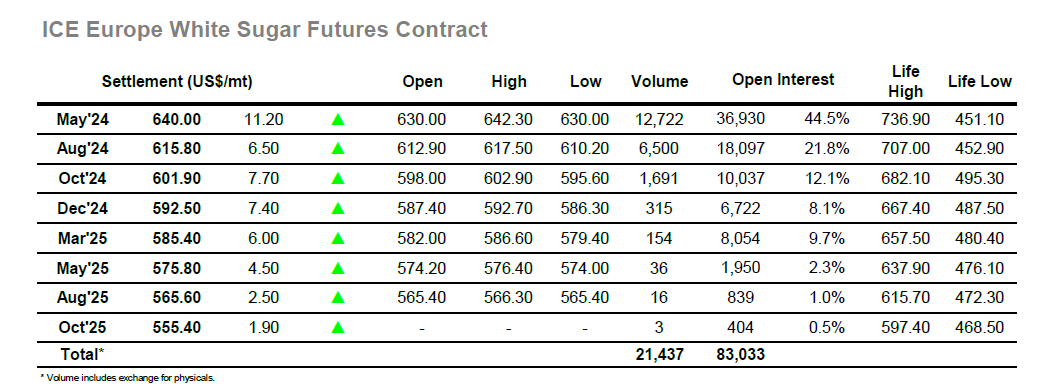

May’24 whites have been buoyant in outstripping gains for all other sugar prompts/contracts over recent days and there was no sign that this trend was ending as the first hour saw the price push up again to reach $636.00. This saw the spreads widening further and the May/May’24 white premium value extending through $150.00, and though a period of consolidation followed there was no hint of reversal and spreads/arbs remained firm. So much revolves around the afternoons and the heavier volumes from the US, but here too the impetus was positive with another round of buying taking May’24 onward to a high at $639.60 before dropping back into the range to consolidate. The drive to continue buying May’24 outright and through spreads was showing no sign of abating as the afternoon progressed, resulting in a high at $641.40 while May/Aug’24 reached $24.10, and while it is appearing overdone in context of other movements there is no sign yet that the buyers are done. Additional efforts to push the market ahead of the close saw a daily high at $642.30, and though some profit taking led to a settlement at $640.00 the chart for May’24 retains a positive appearance.