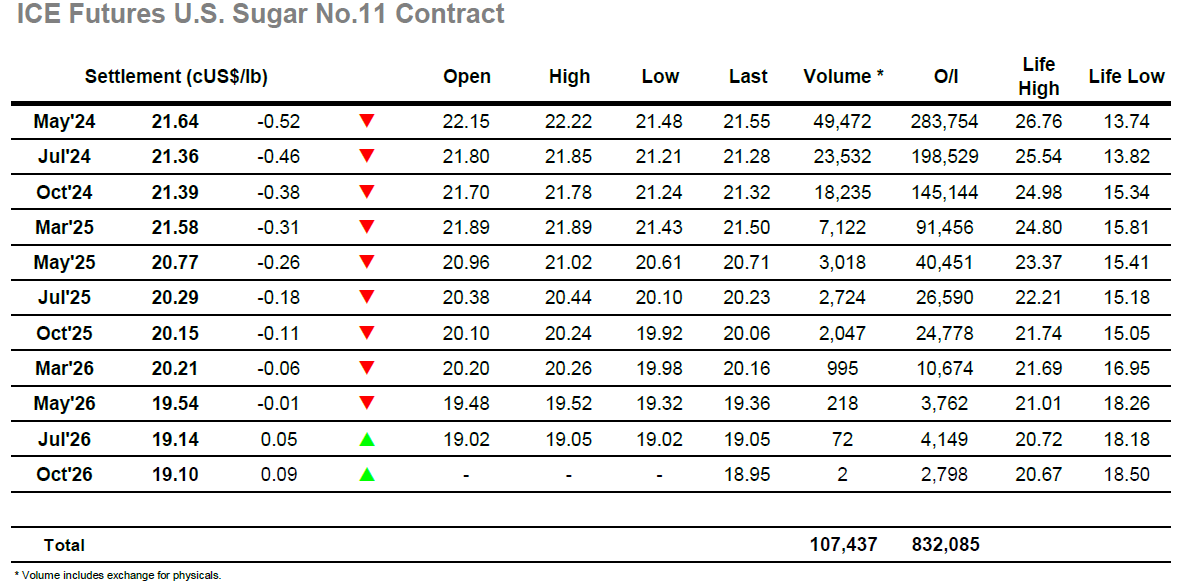

The early part of the session saw May’24 attempting to hold near to overnight levels, but with the market struggling to go higher again it seemed that smaller traders began to lose confidence in recent long positions. Selling appeared to send the price back down through 22c and suddenly it became a snowball effect with selling / liquidation growing as the market ticked lower. Over the course of a couple of hours the price fell back down to 21.52, only really finding any support at the end of the morning and with the start of the Americas day. The buying that followed edged the price back up into the 21.70’s however that proved to be its limits with momentum lost and the price dropping back to the lows. The rest of the afternoon then continued quietly sideways at the bottom of the range, a small drop to a low of 21.48 being about the only highlight of a tedious period. Spreads were narrower due to the selling having been focussed to the top of the board, and May/Ju’24 ended the day at 0.28 points, while for the flat price we had a May’24 settlement at 21.64 to leave prices firmly back into the range.

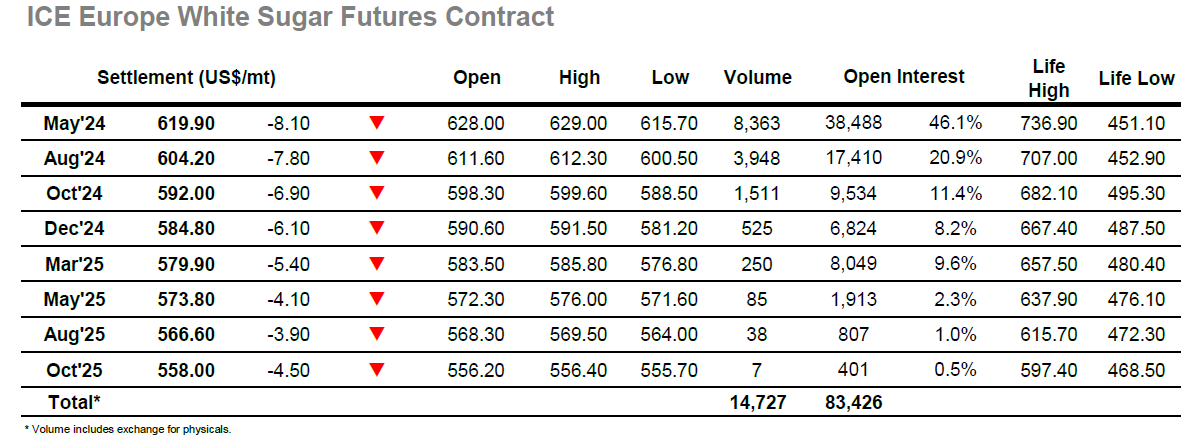

The day started reasonably well with the market holding steadily either side of unchanged through the first hour. Despite this steady start, the failure to be pushing above yesterdays highs and fragile nature of the small trader positions soon drew in some selling, and as long liquidation followed so the market showed some vulnerability with a sharp decline that extended down towards $616.00. This fall clearly unnerved the longs and tempered any desire to jump back in with the action that followed becoming rather more subdued, the market picking slowly back from the lows buy struggling to work back over $620.00. One area which was again unaffected was the white premium where the recent recovery in values continued, with the afternoon seeing May/May’24 move up to $143.00 and Aug/Jul’24 up to $133.00, gains of around $13 for each since the middle of last week. With news still hard to come by the market simply floundered through the afternoon, playing a tight $4 range without showing any serious desire to escape. There was an attempt to push upwards ahead of the close but that failed just above $620, though it did at least ensure a settlement value for May’24 at $619.90, away from the lows but suggesting a continuation of quiet range trading for longer yet.