It was a slow start to the day with May’24 holding a 21.72/21.92 range initially, and though the later morning saw prices pushing a few points higher the market was struggling to break back up through 22c. Eventually there was small push to 22.08, however the highs were seen only briefly before long liquidation kicked in and sent the price sliding down to 21.78. There was fatigue about the specs following a week of largely unsuccessful forays into the market, and though there was movement back up toward the highs following the arrival of US traders it was again on limit volume and merely succeeded in extending the highs by a couple of points to 22.10. Once difference from recent sessions was a widening of 2024 spreads versus the back of the board with only the first four prompts showing double digit gains while 2026 prompts were valued lower, and at the very top of the board there were gains for May/Jul’24 as it reached 0.35 points. The final hour did see marginal new highs recorded at 22.15 with a positive settlement established at 22.12, within striking distance of yesterday’s 22.23 high mark which may encourage another tilt from the long side when the market resumes on Monday.

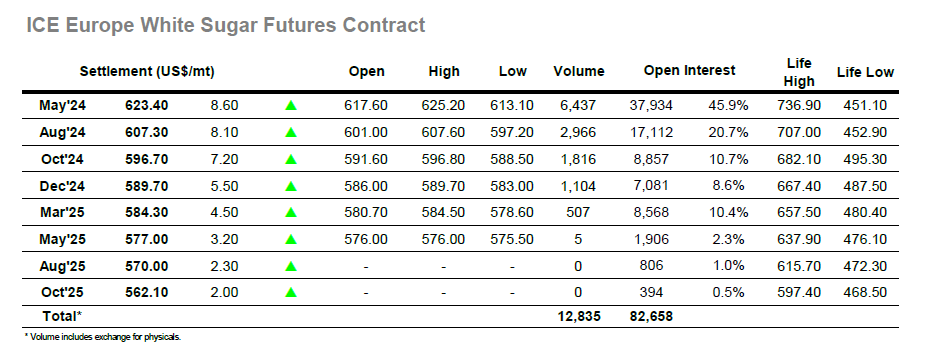

A mixture of activity through the first hour saw early gains erased before the market slowly began to push back into credit. The second half of this week has seen the whites showing more desire to continue higher than the No.11, the late morning push to a new recent high of $624.00 further proof of this while No.11 remains rangebound. This inevitably was positive for the white premium where May/May’24 was approaching $138.00, while for the spreads we had May/Aug’24 trading up to $18.00. Movements are rarely made in a straight line and the afternoon provided some corrective movement back into the range before specs gathered themselves for another push upward, this time reaching $625.20 before pausing. The final part of the day saw the market remain around the upper end of the range, never threatening to rechallenge the highs but still ending positively with a settlement at $623.40 being above the former March high. White premiums softened a little ahead of the close to be valued at $135.75 for May/May’24 and $127.50 for Aug/Jul’24 going out.