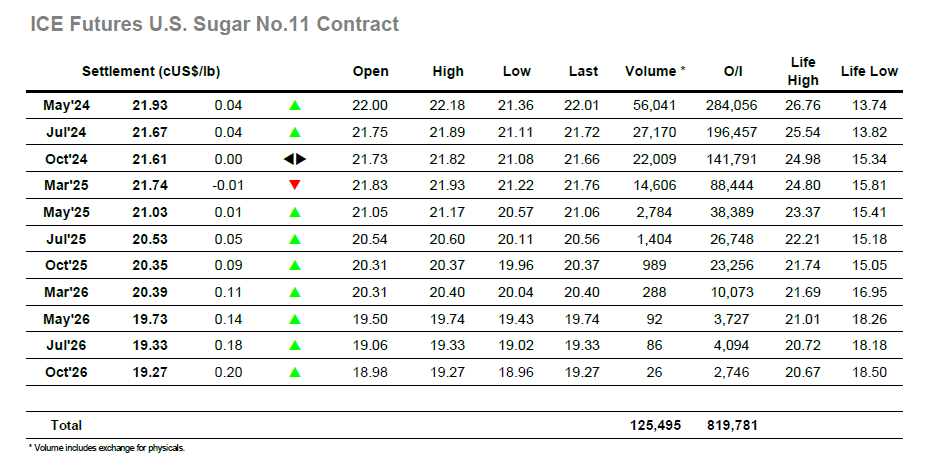

There was some early buying as traders continue to probe from the long side and this enabled May’24 to rise to 22.18 during the first 30 minutes before looking to quietly consolidate the area above 22.00c. By late morning, the market had started to drift with most of the morning losses having eroded however there was no indication of the sudden change in fortunes which was to follow. A drop to new lows triggered a host of selling from specs as they threw out recently established longs, and with algo selling triggered and only a limited volume of buying in place the market plunged sharply. A pause in the 21.60’s was a stopgap on route to a 21.36 low, and suddenly the market had lost much of its recent shine. Of course, with the specs dominating proceedings the movements are only as good as their disposable volume / positions and so having liquidated longs and found some consumer buying interest the market started to build once again with steady recovery back to mid-range. The recovery only levelled out as the market reached the 21.80’s, and with the market now back within proximity of last nights values the picture was able to calm. Alongside all the flat price volatility, there was a distinct contrast to the spreads where movements were relatively light, May/Jul’24 holding a narrow 0.24/0.29 point band and the forward months showing similar sized moves to the spot. The final hour was rather sedate until some late spec buying emerged to ensure a marginally higher close at 21.93 with post close trades above 22c, something which seemed unlikely just three hours prior and which may encourage specs to continue playing the long side for the near term.

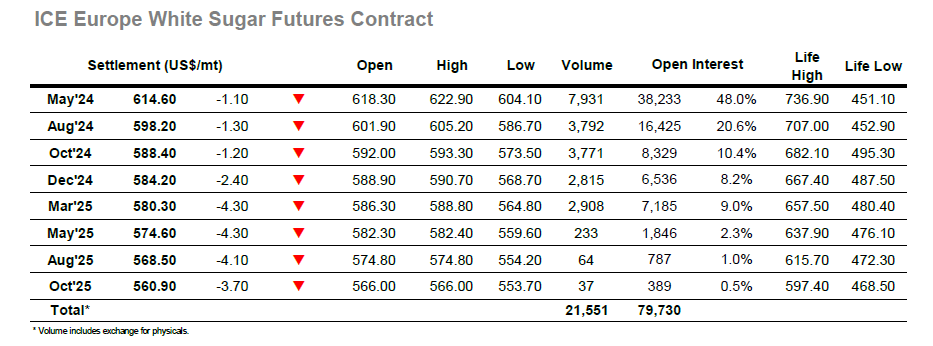

May’24 jumped to $622.90 during the early part of the session however the buying of recent sessions was lacking and so the morning became one of quiet consolidation during which prices slowly eased back to fill the gap on the intra-day chart. Though the smaller traders are long the ferocity with which the market then plunged lower during the early afternoon was unexpected and it suddenly left May’24 firmly back within its recent range as lows were established at $604.10. The real story however was playing out further down the board in the 2025 prompts where huge losses approaching $20 were being recorded, exaggerating the weaker movements from yesterday. This not only meant a widening of the nearby spreads but also meant a sharp decrease for the 2025 white premium values with March/March’25 seeing lows around the $94 mark before starting to recover as bargain hunting appeared. This left the March/March’25 value back up around $101 within the next hour, while back at the top of the board the losses were being erased and the market climbed to sit within a couple of dollars of unchanged. There was little change during the final hour which led to May’24 closing at $614.60 prior to a post close rally, and overall, the market showed some good resilience which may inspire specs to look higher once more.