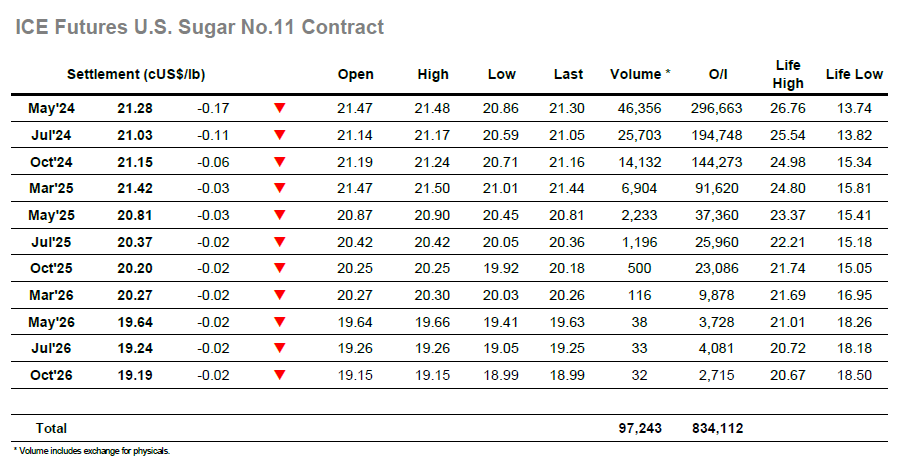

A sharp opening drop to 21.19 for May’24 was initially gathered up however the market was not finding the same level of buying that had been seen yesterday and so by mid-morning we were once again slipping to new lows. With few resting orders placed to either side of the market the decline was occurring against low volume, and by noon the price had extended down to 20.86 almost unopposed with the only salvation coming from short covering once the day traders moved to exit. The recovery proved to be sharp and though the next hour May’24 pushed back to a small credit at 21.47, though the appetite to continue was lacking and we then retreated a little to sit comfortably within the range. Spreads were not seeing a great deal of volume despite the swings for outright prompts and so May/Jul’24 remained settled within a narrow 0.26/0.31 point range. The rest of the day proved to be quiet and prices remained within established parameters to ensure an inside day for the charts, May’24 settling at 21.28 to lead us into Friday with little indication of a preferred near-term direction.

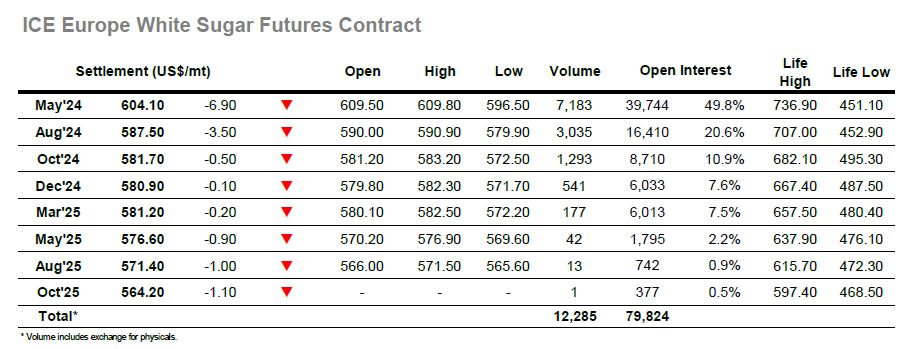

Following the lead being set by the No.11 we saw the market trading lower from the start, and with very little scale buying around the decline soon gathered pace to leave the nearby positions facing sizable losses. By noon May’24 had slipped all the way to $596.50 and appeared set to give back even more of yesterdays gains until some short covering kicked in to bring values back up through the range. The movement was similarly unopposed as it had been on the decline and May’24 recovered to within a dollar of the opening highs before stalling. This left the flat price treading sideways within the range for the bulk of the afternoon, and while May’24 had seen a steady volume it felt rather insignificant in that much of it had simply represented day trader jobbing. Spreads were only lightly traded despite May/Aug’24 dropping back to $15.80 intra-day, while nearby premium values were again choppy as the flat price movements saw May/May’24 swinging either side of $135.00. There were a couple of nudges back to the top of the range as the market meandered through the rest of the afternoon, but with nothing to spark things into life the market eventually edged to a close at $604.10, while Nay/May’24 ended near to the $135 level around which it had been pivoting.