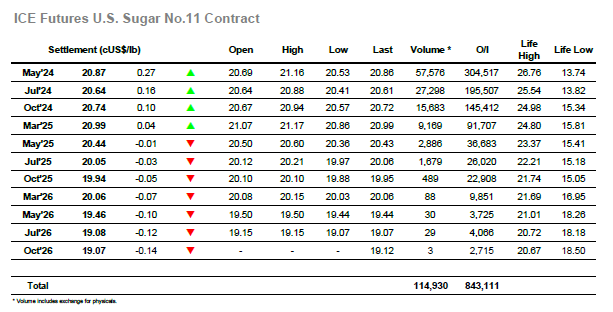

Then recent series of downward days has left the market vulnerable to additional technical weakness, though todays session started in a relatively mundane way with some consumer buying interest holding values in moderate credit on low volume. The specs appeared to be largely absent and so the market did not experience the same level of volatility as usual , with May’24 ranging between 20.60/20.79 until noon. A small dip to 20.53 then occurred as traders looked to see if any sell stops lay beneath yesterdays 20.55 low mark, however it was a brief effort and through the early afternoon the picture remained quietly stable with the price action centring around the 20.70’s once again. Spreads were finding some joy with May’24 firmer against the rest of the board, a positive sign for those looking to pick the flat price back upward, and this situation only improved later in the afternoon when some sharp buying led May’24 up from the tight range it had been holding. The price initially moved to 21.03 and then 21.16 driven by small specs/algo buying, though volumes were still only moderate with their efforts enabled by a lack of resting sell orders. The highs were not sustained with the final hour seeing some position squaring which sent values back to centre range, and though May’24 ended the day higher at 20.87 there remains work to do if we are to establish a bottom from which the market can build.

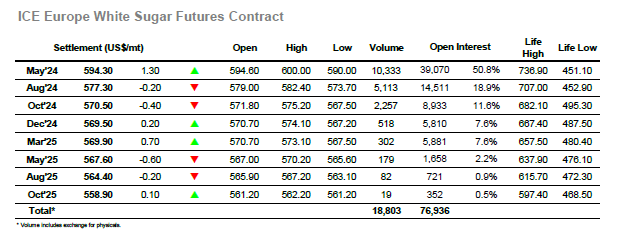

There was some positivity around the whites this morning as overnight hedge lifting took May’24 up to $597.70, a steady start though one which lifted the white premium and spread values a touch to provide some encouragement to longs. It did not last however and having eased back to overnight levels the market proceeded to erode further across the rest of the morning with a drop to $590.00, another recent low for the move. It was not all doom and gloom as this level represented support due to a steady stream of consumer buying interest, though process did not lift by much and instead became caught within a band at the lower end of the range. By now this was reversing the encouraging factors seen first thing this morning with the white premiums particularly seeing a change in fortunes as May’May’24 traded back towards the $133 area, around $6 shy of its early highs. The later afternoon did see the market enjoy a resurgence with May’24 led buying take the price quickly up to $600, though with the specs driving things there was inevitable some profit taking / position closing late in the day which meant that the highs did not endure. Spreads too found some strength on the rally and May/Aug’24 traded decent volumes in reaching a high at $17.70 before ending the day at $17.00. May’24 settled mid-range at $594.30, ending a day which provides little indication as to whether the recent decline has yet concluded.