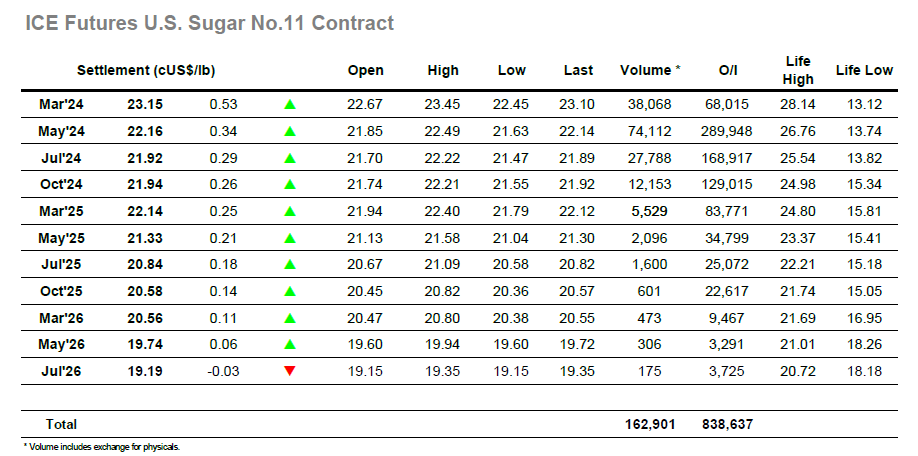

Following a week of quiet retreat the market started negatively once again with a retreat from initial trades at 21.85 to be trading lower at 21.63. Fridays COT report showed that the small spec position of recent time has reduced nearer to flat and now stands at just 10,831 lots long, and maybe this was a factor in the market not moving further south with the likelihood that the live position is near to ‘flat’ and a reluctance for the specs to turn short at the present levels. Across the next couple of hours, the price worked steadily back upward to be holding a small way above 22.00, and with trading then proving calm the May’24 contract proceeded to move along sideways for the next few hours. Despite the flat price calm there was some strength seen at the top of the board with the soon-to-expire March’24 contract pulling away from the pack against spread buying, with March/May’24 trading up through 0.90 points. Until late in the afternoon it seemed that the market would remain near to 22.00 however the specs had other ideas and a sharp push upward saw May’24 reach 22.49 during the final hour, before long liquidation sent it all the way back to close at 22.16. March/May’24 meanwhile remained firm with a daily high at 1.00 points and the spread will remain keenly watched over the remaining three days until expiry.

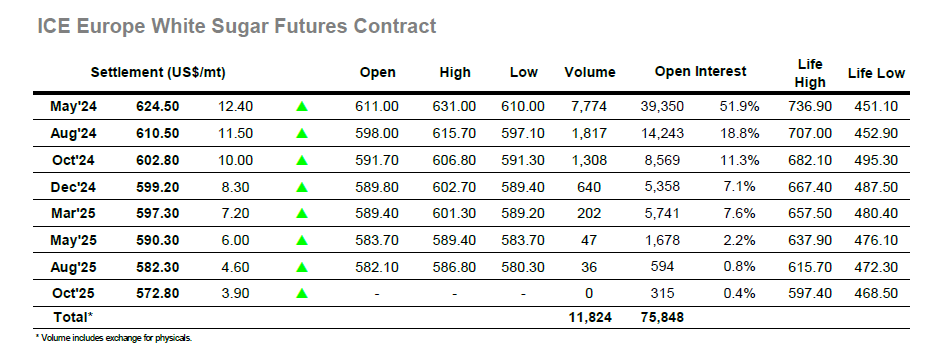

A small opening drop to $610.00 was gathered up to bring the market back into credit before too long and the market then proceeded to stabilise with highs seen at $620.00 before the morning was through. This served to negate some of the recent weakness against the chart and with sellers discouraged the market proceeded to track sideways for several hours against modest volumes. For the next few hours May’24 failed to escape from a tight $3 band, and it was only during the final two hours that the market suddenly came to life. A push to new daily highs encouraged some heavier volumes to appear with the market driven up by spec buying / short covering to rally all the way back to $631.00 and retrace some recent losses. The volume was very much centred around the front month though the impact on spreads was mild with May/Aug’24 only widening as far as $15.40 before easing back against the closing activity. This saw long liquidation take place at a more rapid rate than the previous buying as prices fell back to the lower $620’s ahead of a May’24 settlement at $624.50. This still represented a substantial daily gain while also placing the May/May’24 white premium back up at $136.00, yet there remains much work to do if we are to escape the wider range / malaise.