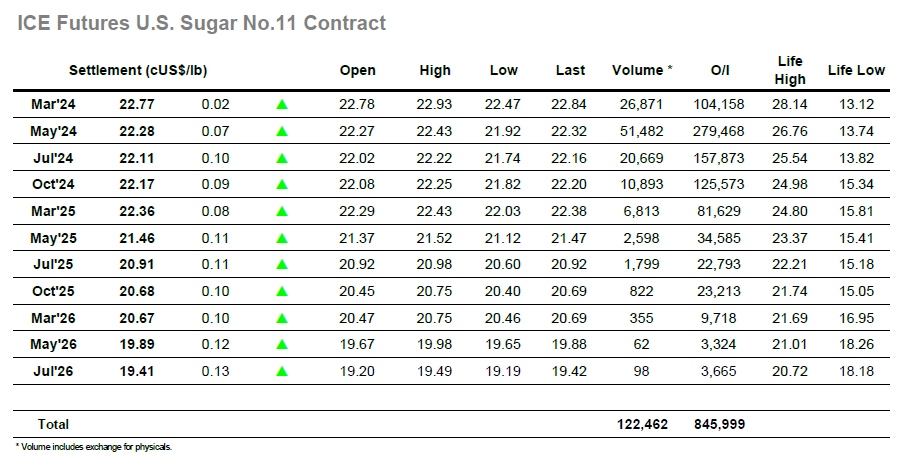

Today No.11 opened at a big gap with lot of volatility during the 5 first minutes of trading. Opening itself was at 22.78, 3 points above yesterday’s settlement but market in a 5 min time was able to reach daily high of 22.93 and retrace back to the 23.50s, a 40 points movement. Daily low was registered just after that moment near 8h45am, at 22.47 and market corrected afterwards. At 10 market was negotiating at 22.60. From 10am until nearly 3h30 pm, market was locked in the 22.55/22.70 range with some price volatility in the early afternoon. It was only at 4pm when market saw buyers coming in, leading to trades at 22.92 (near daily high). Earnings were however frustrated by sellers and market retraced to 22.66 and got some momentum in the final moments to close at 22.84. Settlement price was 22.77, up 2 points from previous settlement. Volume traded was 27k lots and HK spread weakened 5 points settling at 0.49.

Today, in the Whites market, May’24 opened at $621.2, experiencing a decrease of $3.7 USD/Mt compared to yesterday’s settlement. After the opening decrease, the market remained stable with modest movements within the $619-$622 range throughout the morning. Around 13:30, the market had its first peak, rising rapidly sustained by an instant volume that pushed the price above $627 within 15 minutes. Over the next two hours, May’24 experienced a gradual decrease, returning to the opening levels, followed by another spike that surpassed the $629 levels, reaching $629.50 at the day’s high. In the last hour, the market dropped slightly, resulting in the settlement price being slightly below the day’s high. The settlement price was $625.5, up $0.6 from yesterday’s settlement, representing a +0.1% change from the previous session. May’24 recorded a volume of 7K lots, and the K4/Q4 spread closed at +13.5.