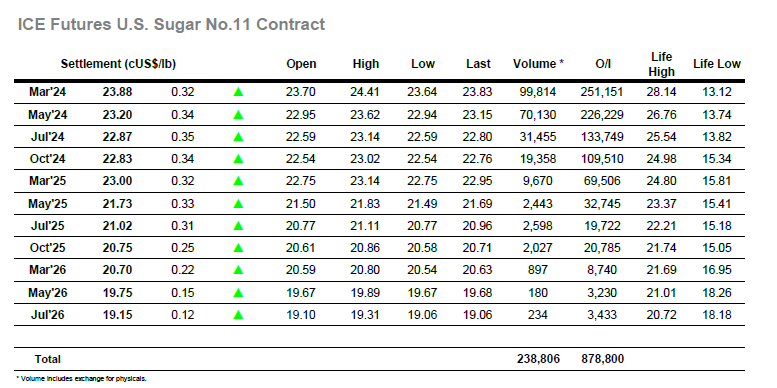

The day began with the market on the front foot with light opening buying sending March’24 up to 23.82, and with gains being maintained through the early period as price consolidated the 23.70’s. A mid-morning spike saw the price extend up to 23.98 however it was a brief foray only and soon the market returned to track along quietly within the range ahead of the Americas day. With volumes being dominated by the March/May’24 spread and Index roll the flat price remains open to wild fluctuation, and with the early afternoon finding a continued enthusiasm to extend the upside March’24 pushed through 24c. Successive waves of buying topped out first at 24.17 and then 24.41, though with some leeway in place for some of the long established on the push upward there was a more limited amount of profit taking being seen than is usual. The picture remained buoyant for a while with fresh efforts made to drive higher still later in the afternoon, though having fallen just shy of 24.41 the market finally saw some day trader liquidation. The release into limited buying saw a rapid drop to 23.80, and though some supportive buying then arrived for the call a settlement at 23.88 leaves the market still confined to the current range and likely to continue pivoting either side of 24c for the near term.  Recent days have seen the market continue to chop around wildly within the current broad range, and there was no sign of this volatility ending as initial activities saw the May’24 contract rise by around $5. Though these gains were not maintained the market was soon picked back up and with market depth remaining incredibly thin the price accelerated ahead to $651.30 before returning to the range against long liquidation, a familiar situation while the trade and larger funds stand aside. Early in the afternoon the market once again began to track higher against spec and algo driven activity, though as the price tracked higher it became apparent that the whites did not have the same drive as No.11. This was evidenced by the March/March’24 white premium which lost $6 across the afternoon to be trading at $128.00, despite the flat price seeing new weekly highs at $665.40 for March’24 and $655.50 for May’24. These highs were well supported through the later afternoon however there was a final twist during the last hour. Long liquidation sent May’24 tumbling back down to $644.90, a mere $2 above the early lows, and with settlement at $647.00 we remain firmly ensconced within the range for another day.

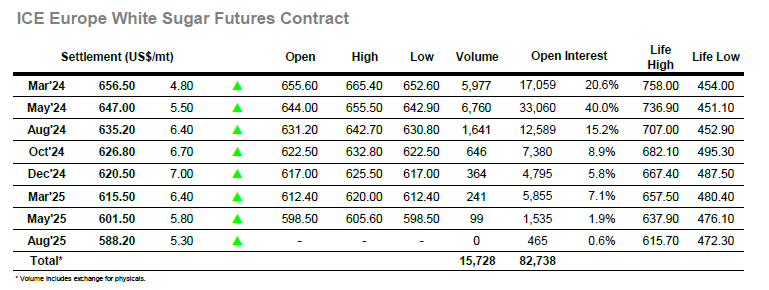

Recent days have seen the market continue to chop around wildly within the current broad range, and there was no sign of this volatility ending as initial activities saw the May’24 contract rise by around $5. Though these gains were not maintained the market was soon picked back up and with market depth remaining incredibly thin the price accelerated ahead to $651.30 before returning to the range against long liquidation, a familiar situation while the trade and larger funds stand aside. Early in the afternoon the market once again began to track higher against spec and algo driven activity, though as the price tracked higher it became apparent that the whites did not have the same drive as No.11. This was evidenced by the March/March’24 white premium which lost $6 across the afternoon to be trading at $128.00, despite the flat price seeing new weekly highs at $665.40 for March’24 and $655.50 for May’24. These highs were well supported through the later afternoon however there was a final twist during the last hour. Long liquidation sent May’24 tumbling back down to $644.90, a mere $2 above the early lows, and with settlement at $647.00 we remain firmly ensconced within the range for another day.

Daily Market Price Updates and Commentary 7th February 2024

Become a Thought Leader on our App

Are you an industry expert in:

• Soybeans

• Grains

• Dairy

• Fruit

• Freight

• Orange Juice

• Nuts and Seeds

• Fertilisers

• Carbon

We’re looking for leading voices who want to contribute their expertise to a global audience.

Find out how a partnership with us works below.

Related content

Daily Market Price Updates and Commentary 17th April 2025

Raw Sugar Update Jul’25 pushed up by around 10 points during ear...

UK Farms Face Dry Conditions, Lack of Government Support

Insight Focus Dry weather and temperature fluctuations are affecting c...

Daily Market Price Updates and Commentary 16th April 2025

Raw Sugar Update The market has endured a torrid run over the past two...

US Sugar Disrupted by On-Off Import Tariffs

This update is from Sosland Publishing’s Sweetener Report. For more ...

CS Brazil: Sugar or Ethanol? 15th April 2025

This report is updated weekly, for daily information refer to our Busi...

Daily Market Price Updates and Commentary 15th April 2025

Raw Sugar Update It was another calm start to trading with this week s...

Daily Market Price Updates and Commentary 14th April 2025

Raw Sugar Update The week commenced with Jul’25 still sitting at...

Sugar Futures and Market Data: 14th April 2025

Insight Focus The raw sugar futures traded lower last week. Both produ...

Want to learn more about Sugar

The Raw Sugar Futures July-October Spread

Welcome to the sixth instalment of Czapp’s course on futures market ...

The Raw Sugar Futures May-July Spread

Welcome to the fifth instalment of Czapp’s course on futures mar...

The Raw Sugar Futures March-May Spread

Welcome to the fourth instalment of Czapp’s course on futures market...

The Raw Sugar Futures October-March Spread

Welcome to the third instalment of Czapp’s course on futures market ...

Biomass: The Future of Renewable Energy

What is Biomass? Biomass is a fuel derived from organic material such ...

What Factors Influence Futures Market Spreads?

Welcome to the second instalment of Czapp’s course on futures ma...

Identifying Relationships in Commodities With Machine Learning

Insight Focus We have used machine learning to research commodity mark...

What is the Carbon Border Adjustment Mechanism?

Insight Focus Importers of carbon-intensive materials to the EU will p...