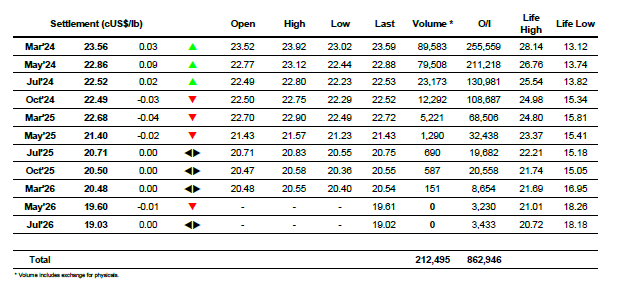

It was a calm but steady showing from the market this morning as March’24 built from a little changed beginning to be sitting above 23.70 by the time that we reached noon. This base encouraged some spec efforts to push upward yet again and there was a small move to 23.92 soon afterwards though once again the move lacked substance. One must admire the fortitude of traders in continually attempting to generate movements despite the market continuing to appear stuck within a range, with this latest move only leading us toward long liquidation and a return to unchanged levels by the middle of the afternoon. Undeterred by this the attention then turned lower with an aggressive push lower seeing light scale buying filled in on route to 23.02 where the market yet again performed an abrupt U-turn and reversed on a position covering scramble. The move did create movement for the spreads with March/May’24 trading down to 0.57 points (from a morning high at 0.81 points), with the wide range coming against strong volume as the start of the index roll brings trade activity to the fore and a strong daily volume approaching 60.000 lots. That the March’24 total screen volume fell shy of 90,000 lots emphasised the paltry nature of non-spread activities today despite the wide range, and so it felt appropriate that the market had returned to be little changed as the close arrived and with smaller traders having closed back out of positions. Despite the 0.90-point range March’24 closed a mere 0.03 points former at 23.56, and with spreads to continue dominating over the coming days its hard to see how the market escapes from the range.

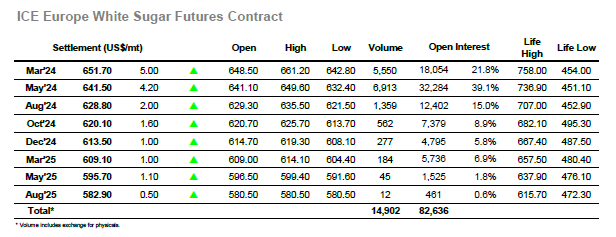

A calm opening saw March’24 tracking along marginally above last night’s closing levels, and despite appearing vulnerable ahead of the opening the market then showed signs of tracking back up through the range once again. The buying was not of any size however with little selling to be found the move quicky extended up to the mid $650’s and in the process extended the white premium value all the way back to $137.00 with No.11 showing no sign of following suit. The gains were maintained into the early afternoon at which stage the smaller traders made another attempt to force higher and pushed to $661.20, though this failed to gain traction and was followed by some quick liquidation. Efforts were made to stem the losses but with the momentum lost the afternoon saw further struggle when another burst of liquidation sent prices tumbling back through the same vacuum that they had earlier risen and through to new daily lows at $642.80. With most of the volume again coming through the March/May’24 spread the market found some stability as day traders now looked to cover shorts, reaching the close with March’24 trading positively once more in the lower $650’s. Settlement was reached at $651.70 with a continuation of recent parameters likely as we move through the week.