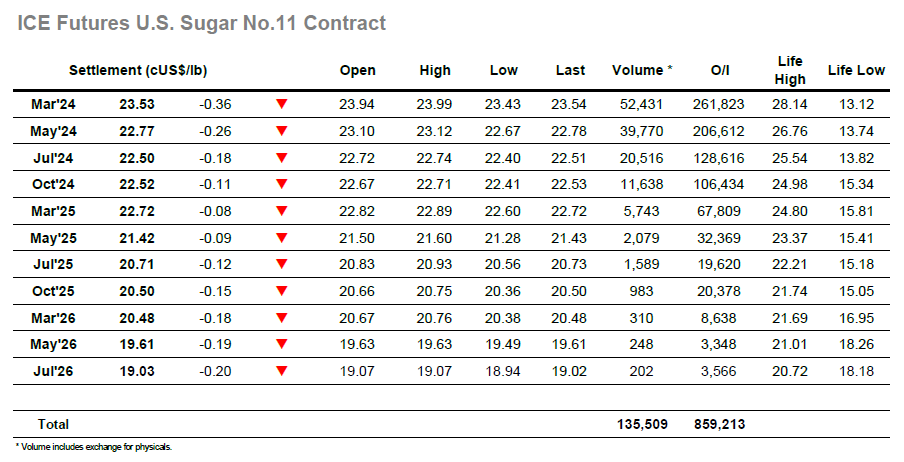

Higher initial trades saw March’24 print up to 23.99 however the buying was quickly concluded and so the market started to slide with day traders playing from the short side. Fridays COT report showed the smallest of movements with the spec position now standing at 23,349 lots long (+180), perfectly illustrating the troubles that the market has in trying to break the current range, while day traders and algo’s dominate. The morning decline extended to 23.59 before short covering sent prices back to a small net gain, and in the thin conditions the market simply began to drift sideways in the hope that the Americas might bring some fresh inspiration. This did not happen and moving towards mid-afternoon the market remained flat with volumes being dominated by the March/May’24 spread where rolling is starting to pick up ahead of the index window which commences on Wednesday. With the market beginning to drift there was another move to push the short side which resulted in a new daily low at 23.43 before short covering kicked in. There was no fresh movement during the final part of the day with the market simply drifting along towards the lower end of the range, concluding an inside day in the process. Settlement was made at 23.53 to leave the broad picture unchanged for another day.

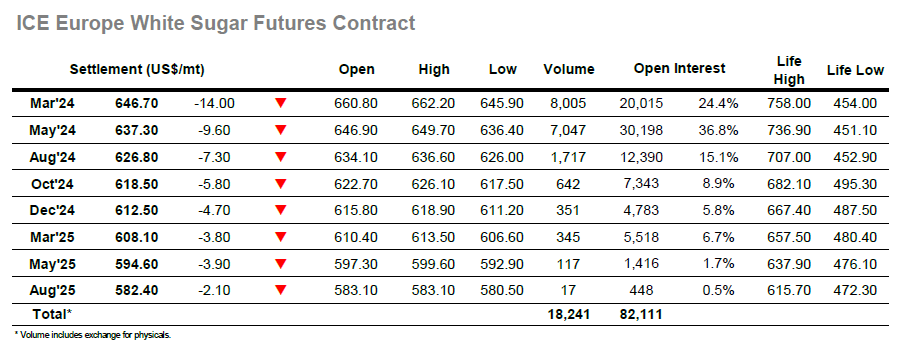

After opening at unchanged the whites came under some heavy pressure, declining by almost $10 to $651.00 with little more than an hour of trading concluded. Support was found in this area with buyers positioning ahead of Fridays lows and following a short period of consolidation the market rebounded against short covering to conclude an eventful morning by returning to overnight levels. These movements while fully within Friday’s range did cause some wide movement for the March’24 white premium which worked between $130.00 and $135.00 as the flat price recovered. With no buying coming from the US to bolster the revery the market once again set off lower, falling easily back through the $650’s and on this occasion moving to a new low for the current pullback with trades down to $647.00. Spreads were also hit as pre-expiry rolling sent March/May’24 down to $9.20, and with little reason for the market to turn around the picture remained weak through the rest of the afternoon. Further session lows were recorded during the final 15 minutes as the March’24 premium slipped back to $128.00, with March’24 concluding the day at $646.70 to appear vulnerable on the chart to additional losses.