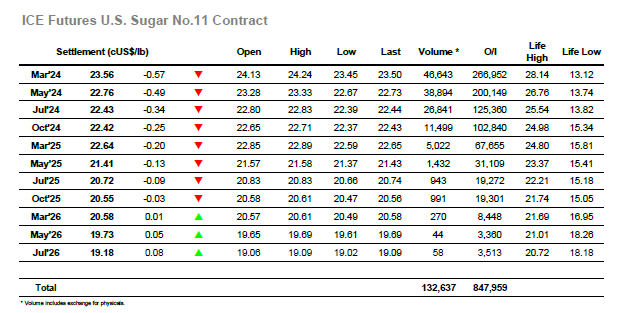

Having pulled itself back up above 24.00 the March’24 contract was looking to find the necessary support that may propel back towards last week’s highs, however initial efforts by the specs / day traders were yielding little success. The market failed to move beyond the low 24.20’s and by late morning there were signs of waning confidence with a corrective washout of longs seeing the price dip back to the high 23.90’s. Not to be easily beaten the specs continued to plug away in the hope that there would be buying found from the US and values remained near to unchanged heading into the early afternoon however as it became clear that there was no other suppoo9rt emerging, so some more critical liquidation took place. With few resting buy orders in place as recent ground is retraced the market saw some sharper falls which by mid-afternoon extended to 23.60, while also seeing March/May’24 back into 0.78 points. There were some efforts to defend these lows however they lacked volume and so a quiet afternoon saw new lows being recorded during the final hour. Efforts to defend the market ahead of the close also fell flat and with eventual new lows made at 23.45 late on and a settlement level of 23.56 the day ended poorly.

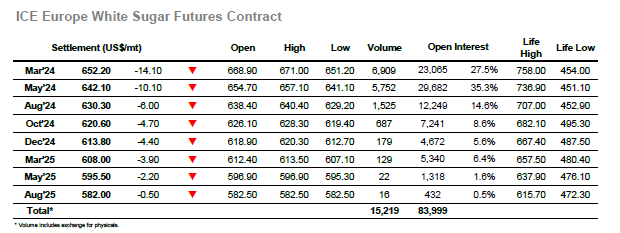

Early trading saw March’24 holding on to minor gains, and this provided the basis through to mid-morning for a nudge back above $670. This week has seen a loss of the recent upward momentum with the whites in particular suggesting that the current rally may be topping out, and the petering of the morning rally and return to overnight levels late in the morning was adding to the concerns that the longs have lost the appetite to drive higher. There was no sign that any additional support was arriving from the US to generate new momentum during the early afternoon, and this seemed to be the precursor for some additional position liquidation which extended the losses through the afternoon. With little buying interest being uncovered March’24 extended its losses to almost $13 with lows at $653.40 while the spreads also took a beating against pre-expiry rolling and March/May’24 narrowed all the way to $10.60. It was not just the flat price which suffered as the white premiums were also back under pressure, particularly at the front of the board where March/March’24 was trading all the way back to $133.00 late on. A poor close saw March’24 settle at $652.20, a dollar above the low and suggesting continued weakness as we head into Friday.