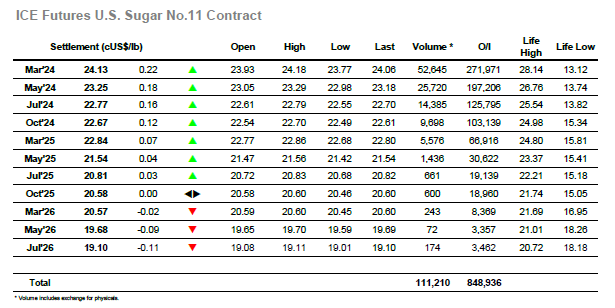

An opening either side of unchanged provided a steady base from which to build upon last night’s bounce and within a couple of hours the market had found sufficient day trader / spec interest to be sitting back above 24.00. A period of featureless consolidation saw March’24 remain in the same vicinity until noon, though long liquidation then kicked in and sent the price back to a small debit by the time that the US morning got underway. With no fresh news and participants fairly agreed on the balance sheet for the time being the market is struggling for inspiration to move far in either direction, something which was notable across the rest of the session. Without the specs/algo’s we would have seen a paltry volume and while their efforts to pick a move generated some activity it merely let prices to continue pivoting around 24c. Marginal new highs at 24.18 preceded a fall back to 23.77, however it meant little and appropriately the market was set fair right on 24.00 just ahead of the closing call. There was MOC buying which ensured a settlement at 24.13 and marginally firmer March/May’24 at 0.88 points, and while this appears positive on the surface it does little to yet change the current picture.

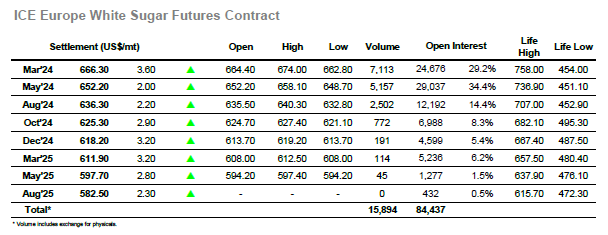

Opening gains were quickly erased, but following yesterday’s collapse for the white premium value there were some viewing the market cheaply and a degree of buying returned. This base drew in more aggressive buying which sent March’24 back into the lower $670’s by mid-morning, redressing the balance from yesterday and taking March/March’24 quickly back to the $142.00 area despite moving on a light volume of just a few hundred lots. Suddenly things were feeling more positive, and the price action remained firm through the rest of the morning though by now the impetus was lacking to make additional gains. There was some early afternoon profit taking which sent values back into the range, however generally the picture was remaining positive due to the recovery in premium values. The pattern continued through a good deal of the afternoon however with around two hours remaining the market showed signs of heading the same way as yesterday. Selling / liquidation hit March’24 and sent the price back within 0.10c of unchanged at $662.80, and though it then picked back up slightly to sit off the lows the premium value had returned to $136.00 and was again showing vulnerability. The market did find some late buying which pulled the flat price to mid-range heading out, though settlement at $666.30 remains unconvincing to anything other than a continuation of the current range.