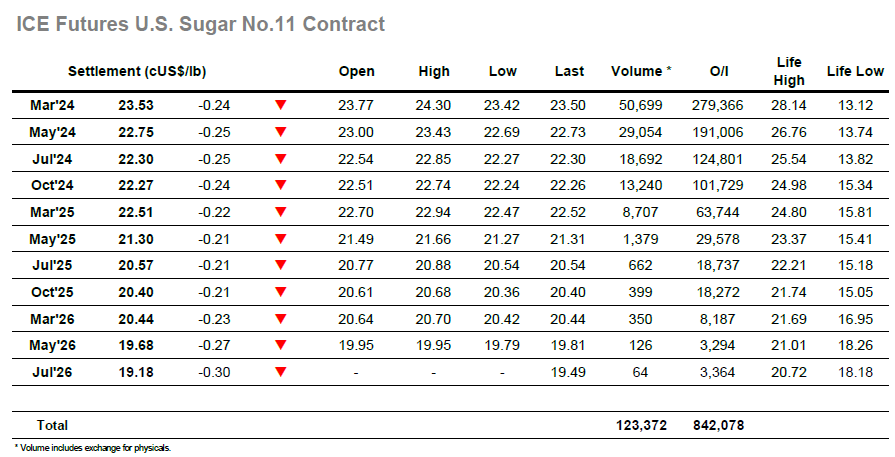

March’24 built upon an unchanged opening to print a little higher during the early part of the session, building upon this start to be looking above 24.00 by mid-morning. As with recent days the movement was coming from a combination of light consumer activity and the smaller specs, with the latest COT report showing only modest growth of the net spec long to 23,169 lots it is clear that larger funds remain disinterested in buying at the present time. Still the smaller specs pushed ahead to try and reverse Friday’s losses and their efforts yielded success with the price reaching 24.30 by noon, providing a solid base from which to try and draw in some US interest. This failed to occur and with the rally based upon limited substance a retreat soon sent values tumbling back towards overnight levels and beyond as the lack of scale interest meant there was little buying into which they could liquidate positions. It was not until the 23.50 area that some moderate buying was uncovered to put the brakes on the decline, though with the damage done and confidence eroded there was no prospect that this could be used to generate another bounce. Spreads by now were also damaged with March/Jul’24 trading down to 1.10 points from a morning high at 1.44 points, and so the picture simply calmed to drift sideways through towards the close. The later stages played out quietly in the 23.50 area, and settlement was made at 23.53, leaving the market appearing vulnerable to additional near-term correction following three consecutive downward days which will have dented the specs’ confidence.

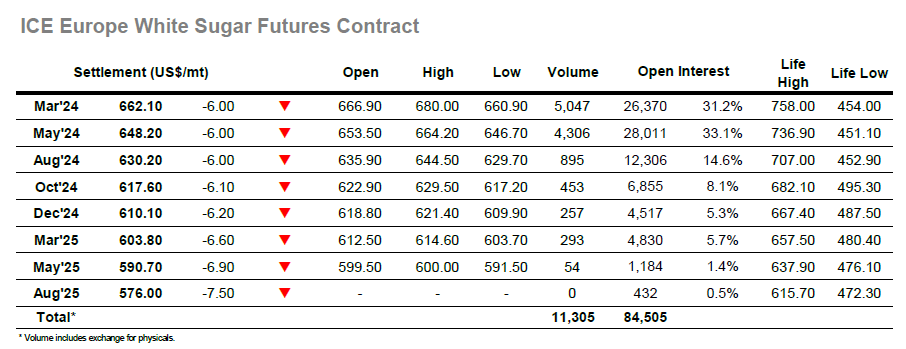

There was light selling for the opening which saw March’24 initially trading lower, however the same could not be said for the No.11 and as the specs looked to try and re-invigorate the upside. This in turn drew some buying into the whites, and as the morning progressed so nearby values moved back into credit and then pushed further ahead through the $670’s. The lack of impetus for the whites was illustrated through the weakness of the white premium values, With March/March’24 dropping to $141 at one stage before picking up back towards $144 as the market built some momentum during the late morning period. Though No.11 was by now stalling the early afternoon saw an additional effort to push the whites ahead with a high recorded at $680.00, and in the process, this took the spot premium up to touch $146.00. though such gains proved to be brief. With few resting orders in place the market began to tumble on long liquidation and the fall proved to be more rapid than the earlier rise, and worryingly for remaining longs it extended beyond Fridays $665.00 low mark. While some slightly larger buy orders were situated in the lower $660’s this simply served to stem the losses and with the smaller traders / specs now disinterested the market stagnated to the bottom of the range through the final three hours. Lows were recorded at $660.90 with March’24 ending the day only a small way above this at $662.10, providing another disappointing performance which seems set to leave values settling back into the range for the time being.