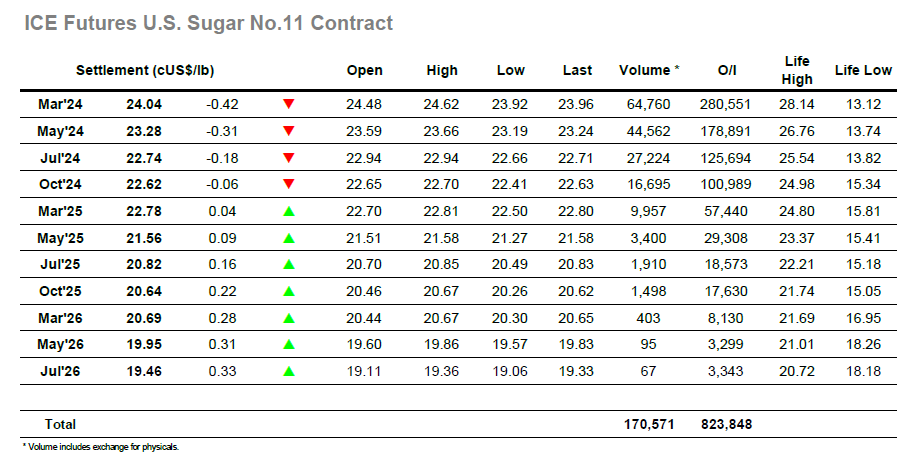

The session began calmly with March’24 trading either side of overnight levels, a steady enough beginning as traders look to build upon the recent technical strength. As the morning progressed the lack of new buying instead drew some light long liquidation that sent the price back to 24.23, though this dip was resoundingly picked up soon afterwards to leave values little changed as we reached noon. Activity remained choppy through the early afternoon, and while the market did push to a new monthly high at 23.62 there was no sign of yesterday’s buying repeating which left the smaller traders sitting long and exposed. The resultant liquidation sent the contract tumbling through the range to new daily lows and it was only having reached 24.11 that some traction was found. Prices returned to mid-range; however the upward momentum was not there and instead prices started to drift through the latter stages. There was an interesting shift in the spreads this afternoon which may mark some kind of turnaround as the gains that had seen March/May’24 to 0.96 points and March/Jul’24 to 1.68 points (even with the market down during the morning) were wiped out and net losses recorded. The final 20 minutes saw new lows as selling returned, sending March’24 to 23.92 on route to a lower close at 24.04.

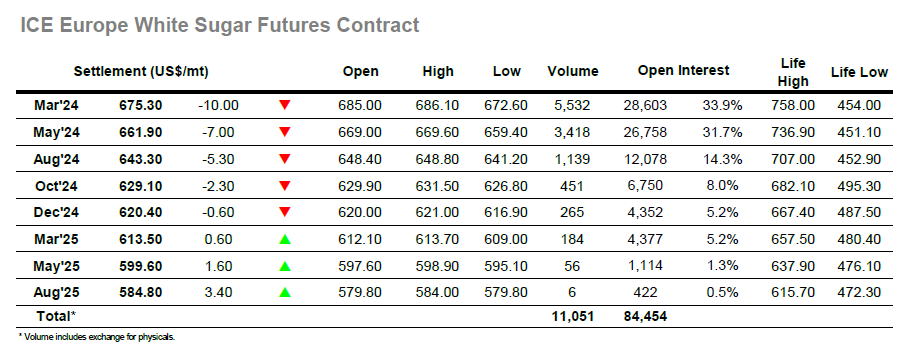

It was a somewhat muted start to today’s session as March’24 edged along marginally beneath last night’s closing levels, the absence of continuation buying providing a surprise. With many smaller traders holding onto longs the lack of buying seemed to erode confidence and a dip to $677.50 followed, though that was picked back up quite quickly to suggest the smaller traders have some differences in the near term view. Through late morning and into the early afternoon te market continued to see-saw, though on one upturn there was a new daily high recorded at $686.10. From the highs we were soon plummeting to new session lows as light liquidation sent values back by almost $10 to $676.20, such was the lack of resting orders within the range. This also knocked the spreads which had previously appeared stable, March/May’24 dropping back to $14.10, while the March/March’24 white premium had given back its hard-earned gains from earlier in the week to be trading around $143.00. March’24 did pull away from the lows during the later part of the afternoon but selling reappeared for the close and sent us out weakly at $675.30, a disappointing showing following yesterdays effort.