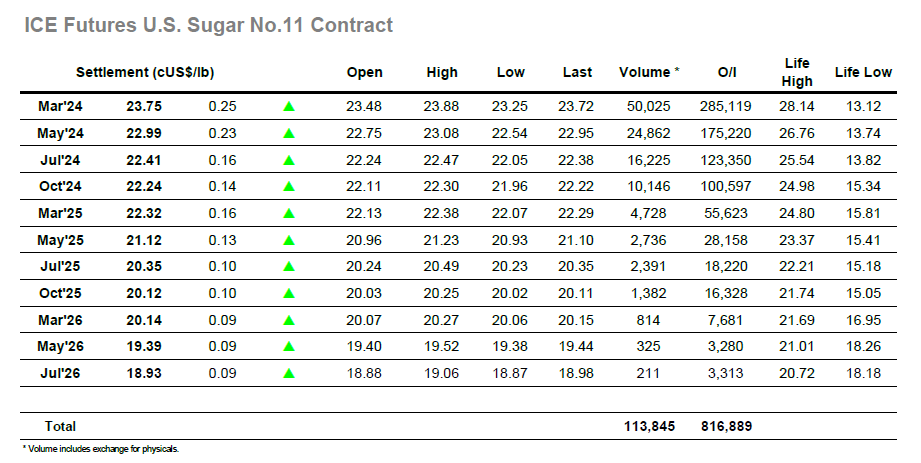

There was selling around for the opening which led to lower values, and throughout a generally slow morning the market showed no sign of recovery with lows recorded at 23.25. There was a brief pop back up to unchanged ahead of the US morning however this failed to garner any real interest and so it appeared that a long afternoon lay ahead. In fact, the specs were just keeping their powder dry as another push launched and drew din more buying interest to take the market up to challenge the recent highs at 23.74/23.75. These were passed with relative ease despite the modest volumes that were changing hands, with more volume noted as the market broke above to reach 23.88 soon afterwards. There was a little more selling at these higher levels and so the obligatory profit taking was to be expected , however the market was now showing resilience and picked back up to sit at the higher end of the range moving into the final part of the afternoon. It was then a flat run through to the close which ended with March’24 valued at 23.75, another her strong showing from the specs as they labour to draw in more substantial buying from funds who so far have shown no tangible interest in doing so .

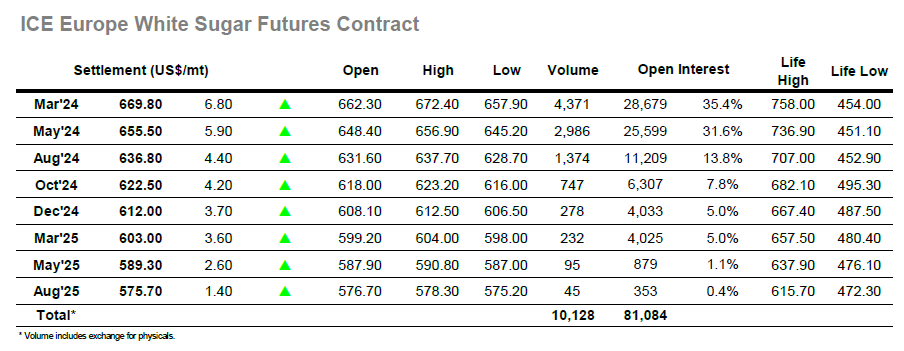

There was light selling around for the opening and this set the tone for a rather subdued morning during which the recent buying showed no sign of reappearing. The market did venture back towards overnight levels on a couple of occasions, but it seemed that the necessary momentum was lacking and by early afternoon March’24 still sat in the lower $660’s. The only recent buyers of any aggression have been specs and the picture changed during the afternoon as they reappeared to break the monotony. Their latest burst drove the price up through the recent highs and on to $672.40 before the inevitable profit taking moves sent prices back into the range, though by now the specs were suitably reinvigorated to ensure the picture remained firm. Through the final couple of hours March’24 sat near to $670.00 while the nearby spreads all showed modest gains in keeping with the flat price strength. White premiums too yielded benefit from the progression with March/March’24 peeking above $146 to send us towards the close looking firm. Settlement was made at $669.80 following MOC buying, achieving a strong close above the previous $669.40 high that may encourage a continuation of the technical strength tomorrow.