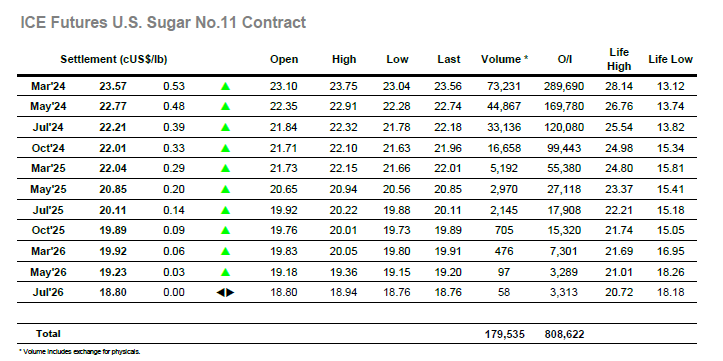

This week has seen fresh momentum found for sugar and with the speculative sector determined to maximise the opportunity presented by more positive technicals the market started on the front foot once again. While the gains were only achieved at a slower pace the March’24 contract still extended upward to 23.28 over the course of the morning as traders looked to maintain the gloss in the hope that US specs/funds may follow with additional support later in the day. These efforts were duly rewarded as the early afternoon saw another drive higher that took March’24 to 23.58, the gains being achieved comfortably with producer selling only showing intermittently. As with recent moves there was significant benefit to the nearby spread values from the outright gains, with March/Jul’24 some 0.25pts former at 1.47 points as March’24 extended onward to 23.75. Some pre-weekend profit taking / position squaring was to be expected and so a sharp correction to 23.33 raised few eyebrows, and once the selling had concluded the market levelled back out to maintain solid gains. There were some small upticks into the close as defensive buying ensured a strong end to the week with March’24 settling at 23.57.

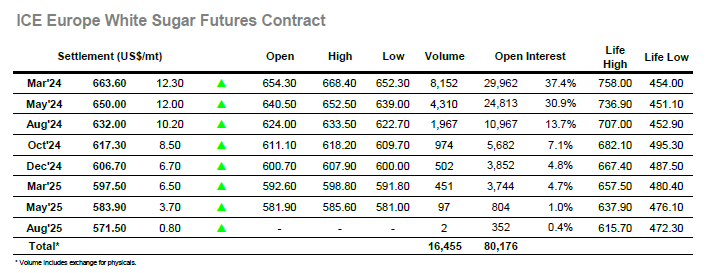

The market looked to continue where it left off last night as March’24 opened a dollar firmer and then continued quickly on to $656.80. Progress then slowed, however there were few willing to step in against the momentum and so prices remained quietly firm and remained well placed in the upper $660’s reaching mid-session. As ever it took the arrival of the Americas traders to generate greater momentum with buying coming into the No.11 and rippling through to drive the market further ahead. There was some intermittent producer pricing on the way up however that was not sufficient to halt the price rise, and by mid afternoon the market was trading another $17 higher at $668.40. Such sizable gains naturally drew in some selling / profit taking and this led the price back to $657.90 before once more looking to consolidate. The picture was somewhat calmer through the final hour with longs seemingly content to head into the weekend on the back of another strong showing. White premiums ended the week solidly with March/March’24 at $144.00 and May/May’24 at $148.00, while for the nearby spreads there was a pullback from earlier highs as March/May’24 retreated from $17 intra-day to settle at $13.60. March’24 settled at $663.60 to conclude a very positive week.