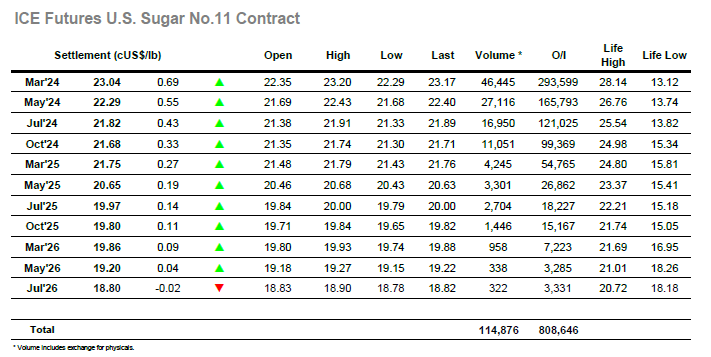

A subdued start to the session saw March’24 trading near to overnight levels however after an hour things started to pick up with the smaller specs again looking to push the market from the long side. A steady climb ensued over the next couple of hours which saw the market move to within a point of yesterday’s high at 22.68, though as with yesterday it lacked the necessary buying to push on and so set back to consolidate while waiting to see if the US morning would bring additional support. It did bring some buying with another push back into the 22.60’s, however volumes continued to be low and so another period of range trading developed through to mid-afternoon. Ther specs have a determination about them though and another move was mounted and on this occasion the market managed to punch through 22.70. Initially the progress was limited however sufficient buying was in place to continue higher through the final couple of hours, taking March’24 to 23.00 ahead of the call. Spreads were also buoyant on the move with March/May’24 reaching 0.77 points and March/Jul’24 at 1.29 points, enhancing the positive glow. With the chart looking good and the market at its highest price since 13th December there was a final push to enhance the long positions on the close, ensuring a strong settlement level at 23.04 ahead of the post close where highs of 23.20 were recorded going out.

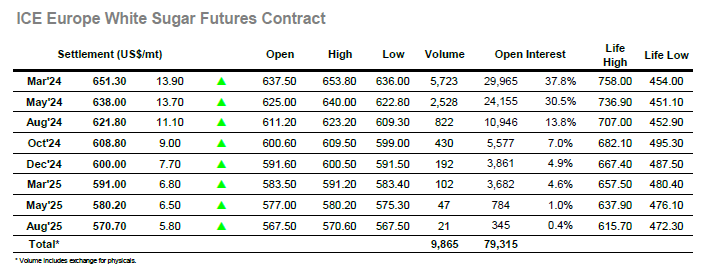

A slow start to the day saw March’24 consolidating either side of unchanged, however this soon ended as speculative buyers once again moved to try and push the market higher. Their determination to shake off yesterdays slide and try again was impressive and while the market remained a little way shy of recent highs to sit in the $643 area the gains were providing a good base from which to try and look higher during the afternoon. The arrival of those in the Americas did nothing to change the picture and the market continued to move sideways for several hours, and it was only during the final couple of hours that some fresh movement arrived. It was certainly worth waiting for as March’24 moved tentatively through $646.00 before finding some stronger buying and punching upward, meeting little resistance as prices worked towards $650.00. The movement was matching that of No.11 and so there were no significant moves being seen for the white premium values while spreads also were only seeing modest gains, March/May’24 reaching a widest $14.60. The flat price was in a different world however and as specs piled more buying in for the close to ensure a strong finish the March’24 price popped again to a daily high at $653.80. Settlement was made at $651.30, leaving the market well placed to continue the rally and try to end the week strongly.