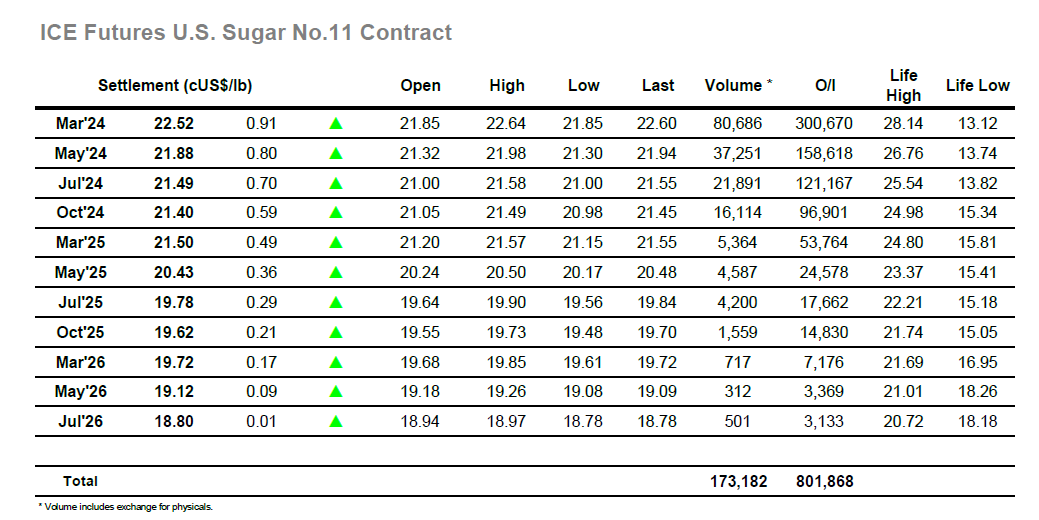

Returning from the 3-day weekend the market was immediately indicated higher against yesterday’s white sugar activity, and impressively it made the call with opening prints at 21.85 leading to an immediate move up through 22c. The rally did not pause until 22.33 had been reached, and though there was some inevitable small trader profit taking emerging the consolidation pattern was solid with activity remaining above 22.00 throughout the morning. Friday’s COT report had shown the next spec long reduced to just 5,429 lots, however today’s activity showed that there does remain an enthusiasm to buy (amongst the smaller specs at least) with the busier afternoon period seeing buyers in the ascendancy once more. With specs finding a new freedom to accumulate longs against the technical breakout the market continued to extend the gains, with the front of the board touching to 22.50 before more profit taking took place. The spreads were also buoyant with March/May’24 reaching an intra-day high at 0.67 points, and both nearby positions making gains against the middle and back months as the buyers focussed on the top of the board. Though the specs were most prominent today there were signs of producer pricing taking place, the first tome it has been apparent this year as some look to begin pricing on scale to take advantage of the price recovery in anticipation that fundamentals are not currently as favourable as those which led the market to 28c last year. Still, that did not deter the specs from ensuring a positive technical close that saw March’24 settle at 22,52 ahead of a session high at 22.64, providing potential for further gains should the specs continue buying.

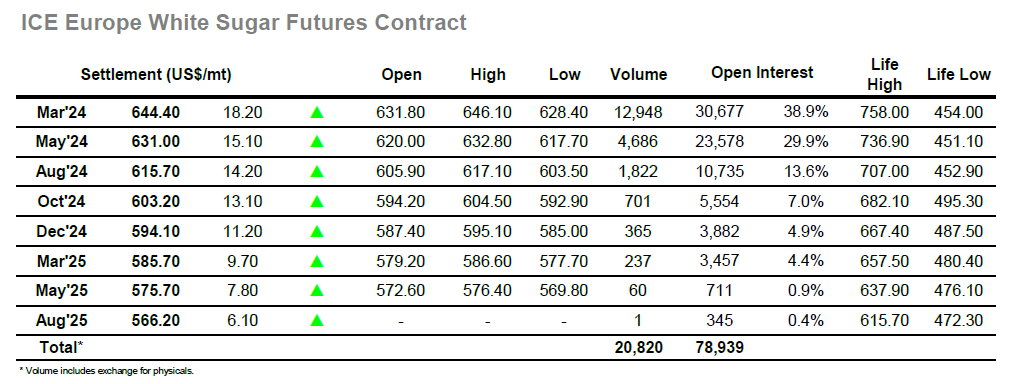

With No.11 having responded to yesterday’s strong performance the whites emerged firmer with March’24 around $6 higher on the opening. Buying followed in reaction to this strong showing and through the early stages March’24 rose to $635.80 until an understandable pause in the buying allowed for a period of consolidation within the confines of the early range. With the market static some light selling emerged around noon to send the price back to $628.40 and conveniently fill the overnight chart gap, though with spreads still performing well there was little sign that this would lead to a turnaround in fortunes. A further pause followed before the market found new upward momentum moving towards mid afternoon on buying from both specs and consumers. There was some light scale selling in place, but it provided little resistance to the array of buying being placed at the front of the board with March’24 rising all the way to $643.00 while March/May’24 worked back out to $13.60. Nearby white premiums were also strong and in a continuation of the move the fortunes of the market only improved as the close loomed. Another session high was registered at $646.10 while the March/March’24 touched to $148.00, a remarkable showing as the market breaks away from the recent range. March’24 settled at $644.40 with potential for additional near-term gains should the specs look to further add to their longs.