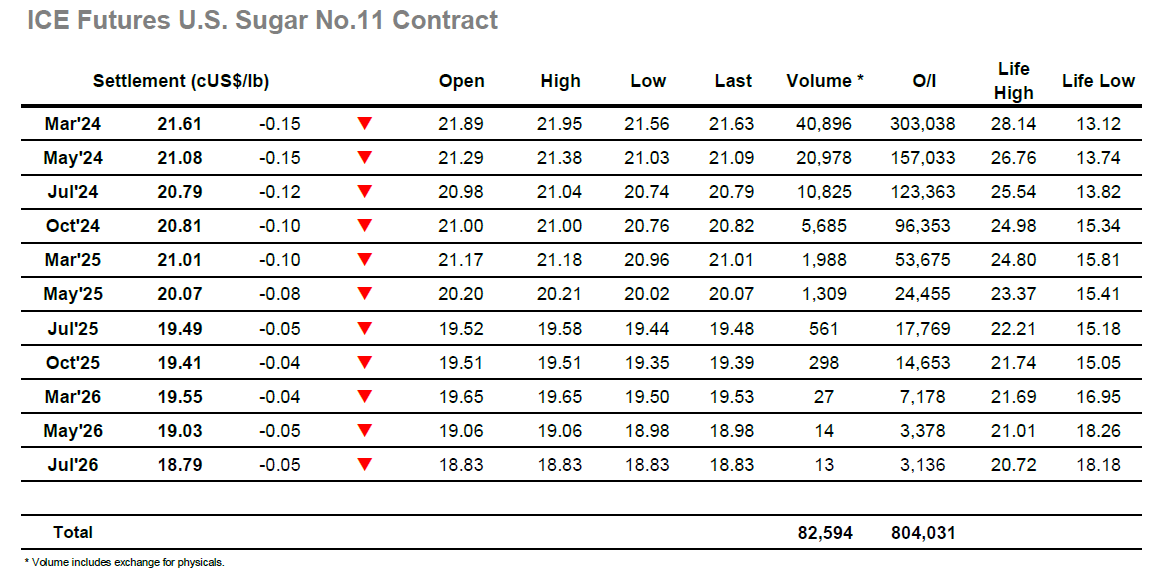

There was early buying in the market and through the first hour we saw March’24 move into the 21.90’s, the fourth consecutive day on which it has done so, this time trading just a point shy of the recent high at 21.95. On each occasion the sight of scale up selling has deterred the buyers with the small specs feeling that they lack the backing for a more sustained push, and today proved to be no different with a return to overnight levels before the morning was through. There was a feeling that the prospect of a close above 22c heading into a 3-day weekend could bring some more robust spec interest and the afternoon saw traders priming the market for such opportunity by bringing March’24 back to the morning highs, though their efforts were futile. Instead, the market again failed to progress, and the resultant liquidation sent the price slipping to 21.63 in quick time. This let to a little more volatility through the final part of the afternoon with a bounce failing to garner support before pre-weekend position squaring saw session lows recorded at 21.56. The close was made at 21.61 to leave the market still rangebound as we reach the middle of the month, still lacking the necessary news to force a break to either direction.

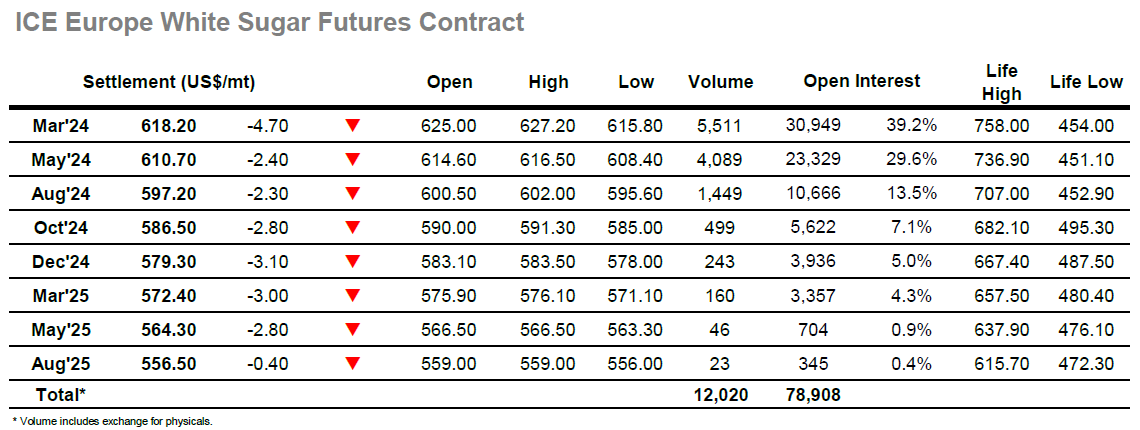

The market started on the front foot once more with a push up to $627.20, however there is an area of congestion which has proved to be a barrier this week and with no significant buying following behind the market dropped back down to the lower $620’s. The outright volume then began to fall away to leave prices drifting sideways, though overall volumes were proving a little higher thanks to some better volume for the March/May’24 spread which was seeing steady selling take the differential lower. This was also impacting upon the white premium values which saw March/March’24 drop back from the $143.00 area to be trading beneath $140.00, though the rest of the board saw values being retained. The flat price was calm until a No.11 led sell off drew in some selling of our own to break new daily lows and led to pressure which remained on through the rest of the session. Traders forced March’24 back to $615.80 ahead of the close and while there was a late bounce against position squaring the settlement value at $618.20 does little to inspire interest heading into next week with Monday likely to be quiet as the US enjoys a public holiday.