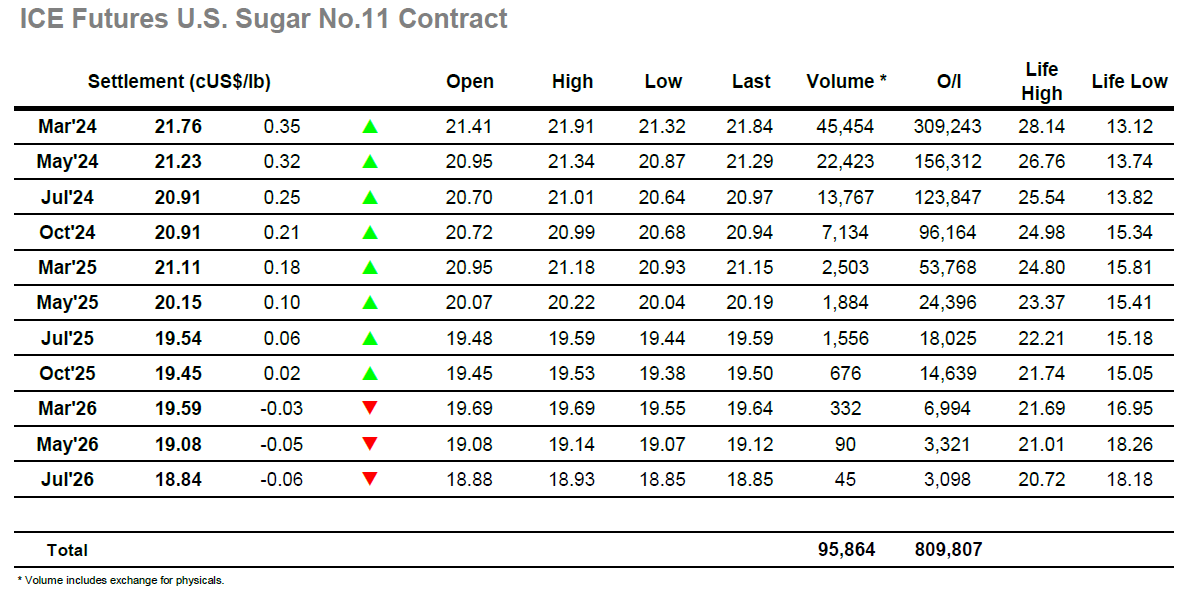

Having fallen back into the range yesterday the market was initially muted with trades either side of unchanged before attempting to climb back upward. This effort only reached 21.53 before halting and some similarly slow selling followed to send prices back down with a small debit showing as we reached noon. It was apparent that there was no interest in selling the market further back down through the range and so with the US morning drawing additional day trader / spec buying into the environment the market climbed to new daily highs. Over the next few hours a steady rally ensued to reverse yesterdays losses, aided by the latest UNICA news which showed for the second half on December 4.872mmt cane / 0.366mmt sugar / 37.09% mix / 136.93 kg/t ATR, While these numbers represent very small beer in context of the crop which is now at its tail, the lack of news encouraged some traders to take it as a sign of weather impact upon this year’s crop and so it was not until the market was back within touching distance of the recent high at 21.91 that we paused. The retreat against long liquidation seemed set to leave the market heading out to the centre of the days range however a final burst of spec buying arrived to achieve a positive conclusion. March’24 traded up to 21.88 on the post close though settled some way below this at 21.76, still a steady close and with some potential to investigate the upper end of the range ahead of the No.11 market holiday on Monday.

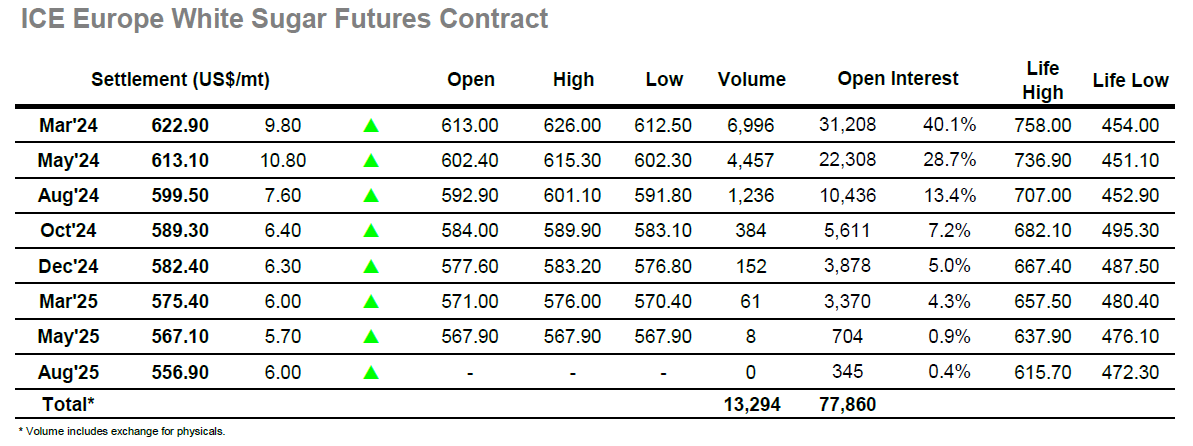

It was another slow start to the session as March’24 dipped lower before finding a degree of support and sitting slightly higher, however with volume s remaining light there was no sign that prices could push away from current parameters. As often seen on low volume it took the arrival of US based specs to generate additional movement with the afternoon bringing a run back up through the recent range, recovering the losses that had been incurred yesterday to reach a session high $626.00. Interestingly the move did not involve a recovery of the nearby spreads which were trading down on the day (March/May’24 around $9.00), a factor which may hinder any sustained recovery efforts despite the resilience being shown. With the market still stuck in a range it was not surprising that the progress stalled with liquidation / profit taking seen on a retreat into the range, and with news still thin it seemed that we would end this way. That was not the case as a final push from specs appeared and sent values back upward through the final 10 minutes, a close at $622.90 for March’24 providing encouragement to bulls as they look to break from the current stalemate.