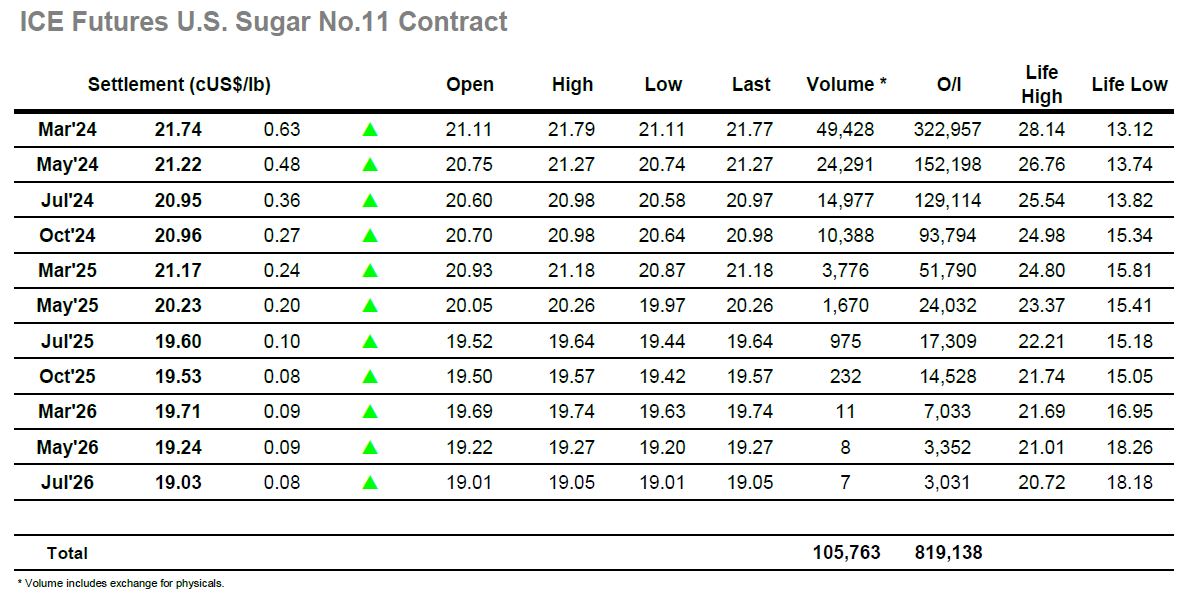

Opening prints at unchanged led into an early rally with March’24 working into the 21.30’s before levelling out to consolidate the gains. Friday’s COT report showed a negligible reduction in the net speculative long to now stand at 17,343 lots and with no other significant news to influence the market it seemed that the movement was purely built on physical activity combined with some renewed confidence that the market is building a bottom through last weeks rangebound trading. Trading was flat through the rest of the morning however the higher platform did lend encouragement to the US specs and so the early afternoon saw a small push to new session highs though it ended abruptly. Such moves have killed the upside potential recently with small traders taking any failure as a sign to reverse but that was not the case today and having regrouped the spec sector returned to push upward once again to reach a high at 21.75, Nearby spreads were firmed against this buying with March/May’24 trading out to 0.51 points and with the flat price trading at its highest since 29th December the support endured through to the close. New highs were recorded against MOC buying ahead of a settlement at 21.74 placing the market positively to challenge the recent high at 21.91 and investigate whether the area beyond 22c might contain an increased level of selling.

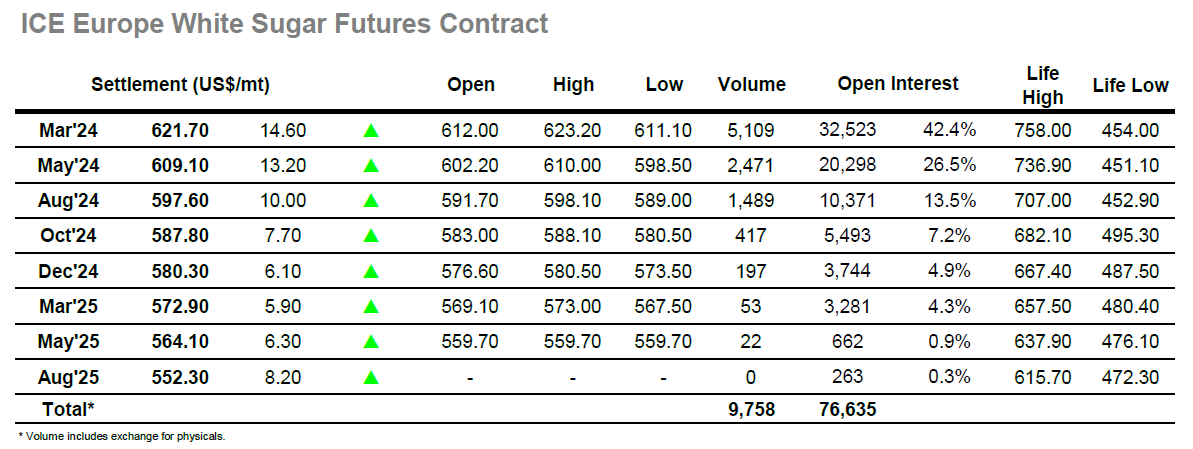

Buoyed by a firmer No.11 market the whites gapped higher on today’s opening, and despite only seeing modest volumes appeared comfortable with a period of consolidation seeing Narch’24 site in the $613.00 area. There was little to report through a slow morning and it was only the arrival of some fresh spec interest as we moved into the afternoon that generated additional movement with March’24 moving up through the teens and then flipping around the range as the day traders moved in and out of the market. While there was no definitive direction to the market the trend remained higher with fresh ground being broken as the afternoon wore on, March’24 moving above $620 though remaining short of late December levels. Through the movement there was only moderate change for the white premiums with March/March’24 remaining in the lower $140’s, though May/May’24 did make a little ground and moved above $141.00. Spreads were also quietly steady and March/May’24 saw a daily high at $14.00 though eased from that to end the day at $12.60. There was buying in place for the close which ensured a solid finish at $621.70, leaving the market well placed to look at the $625.80 high from late December as traders attempt to break away from the recent band and generate some new momentum.