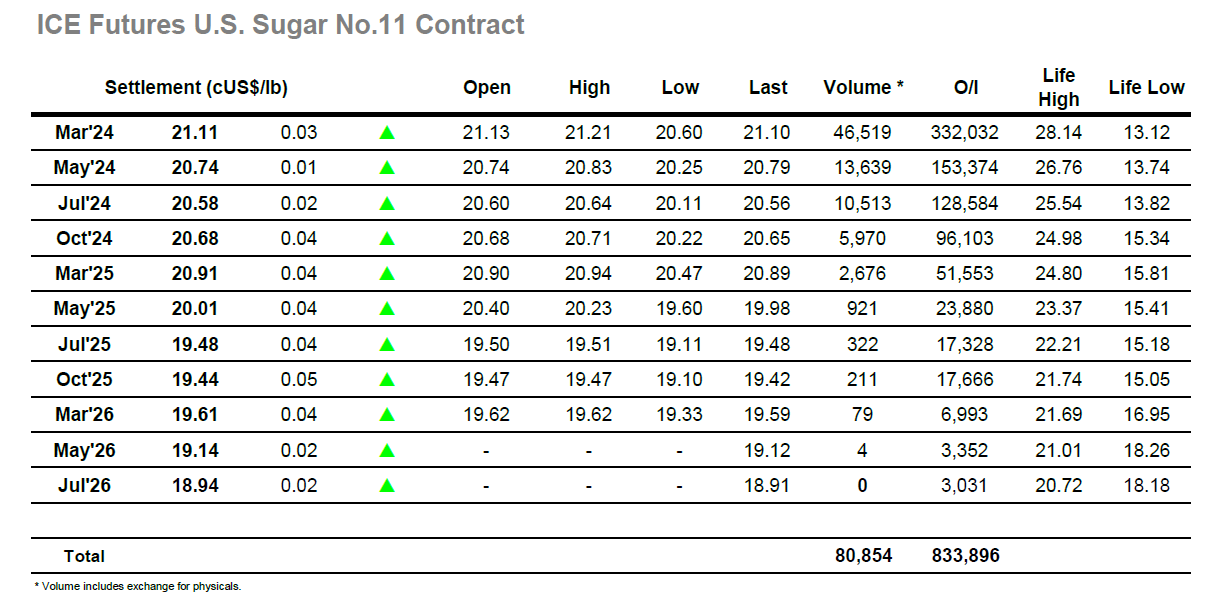

It was a mixed start to today’s session with only the usual light volumes changing hands, the one discernible difference from the rest of the week being that there was clearly less hedge lifting taking place to limit the initial bounce. The picture calmed with March’24 sitting just beneath 21.00 and a slow morning ensued through which the price drifted marginally down as it survived only on fumes. The start of the US morning brought with it a small spec push down to 20.60, matching Tuesdays weekly low before bouncing quickly back upward when short covering took place at the sight of some (relatively) larger scale orders from end users. This returned values to the centre of the range and from here it felt as though some smaller traders decided to call it for the week and step away. There was a little more chopping within the range during the later afternoon, but it means little, and the market sat comfortably around 21.00 with the close approaching. Late buying (position squaring) took place on the close to leave March’24 settling marginally higher at 21.11, and with tonight’s COT unlikely to show significant change to the current small net long position the current stalemate will likely continue into next week.

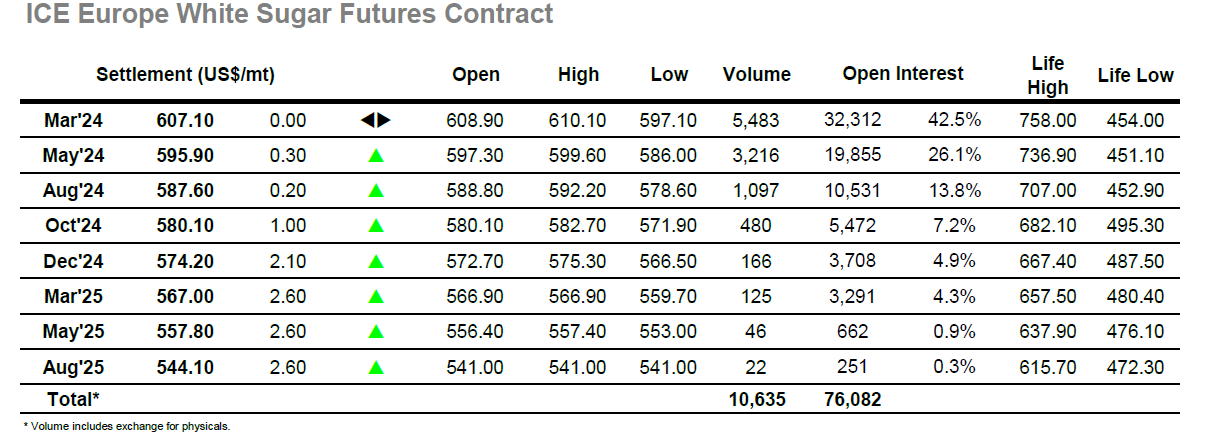

A lower start to the session marked a break from the pattern of trading this week, though with buying showing up ahead of $600 for March’24 there was still no sign that the market would break from the current range. Sideways trading then prevailed through the rest of the morning, the quiet conditions leading traders to look to the US to see whether there would be any pre-weekend interest to break the monotony. Some additional selling did appear during early afternoon which sent the market to new session lows with March’24 at $597.10 and the March/May’24 spread down to $9.50, but with prices holding above the weekly low of $596.00 some short covering followed to pull values back upwards. There was a little more movement through the afternoon with the price briefly swinging back into credit as day traders switched around, however to many it was merely background noise with only limited interest from the trade/consumers. Prices pushed back to the upper end of the range late on to leave March’24 settling at $607.10, bringing the week to an appropriately quiet conclusion.