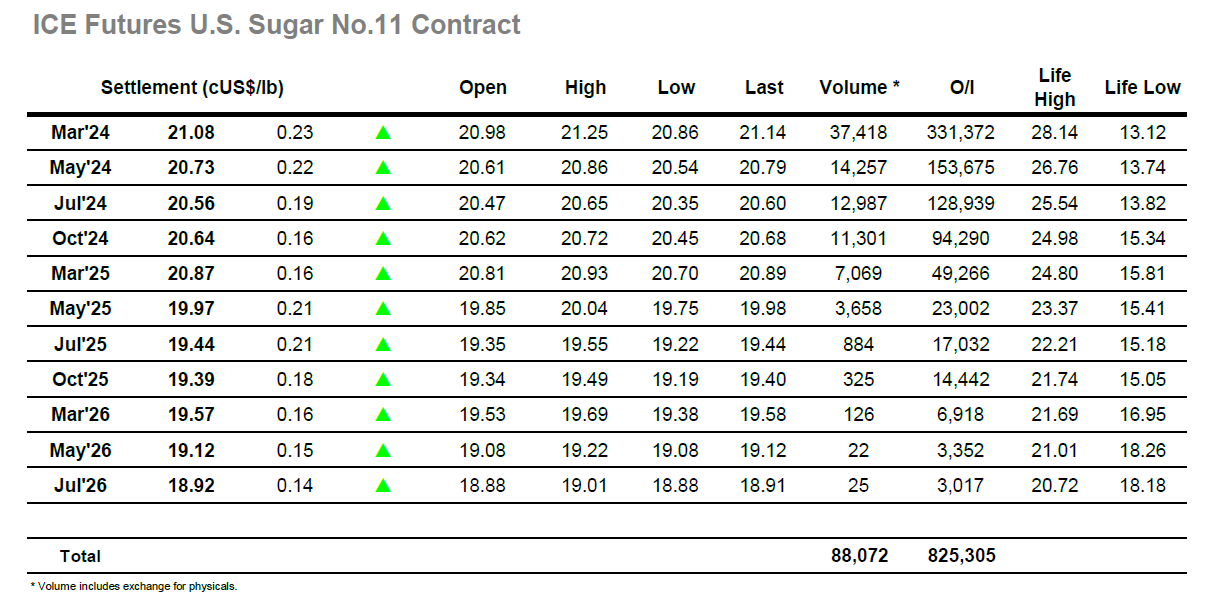

The new year has seen the market take on a calmer approach within a range, and though the early part of the session saw March’24 shoot up to 21.18 the movement was based on only very light buying with no sign that the interest was there to force a break of current parameters. With most of the interest coming from the day traders a retreat on liquidation was inevitable at some stage, and it arrived quite quickly with lows recorded at 20.86 mid-morning before prices levelled back out in the 21.00 area. The afternoon saw a continuation of this pattern, but just with a moderately higher volume as small traders in the US joined. There efforts yielded no more success than the morning however with a small extension of the range to 21.25 still leaving the market shy of this week’s highs. Small movements continued within the range as the rest of the session played out but on limited participation it was apparent that an inside day would endure. MOC buying meant a settlement at 21.08, ending a slow day with expectations of additional range trading for the near term.

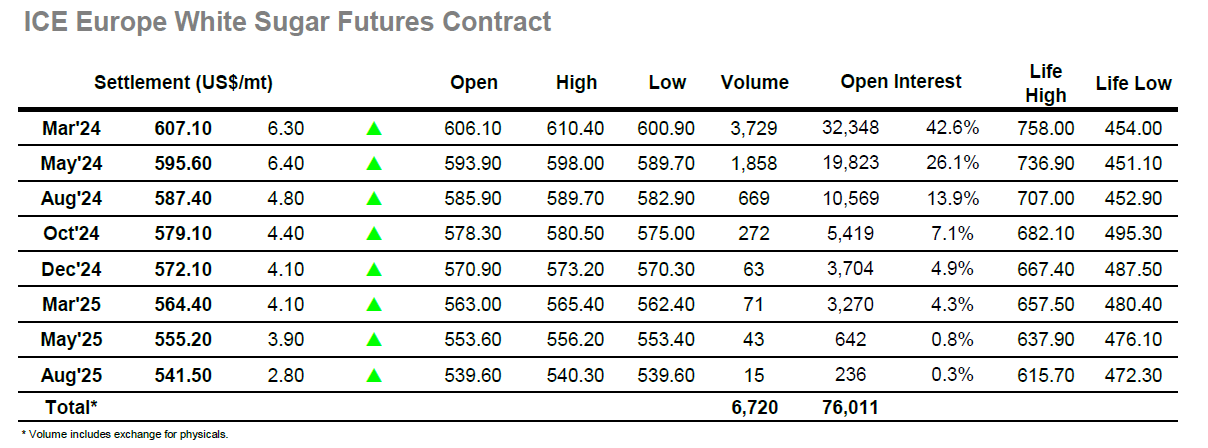

There was a familiar feel about the market this morning as initial buying led March’24 up to $607.40 before the price followed the recent pattern and eased back, filling the gap on the intra-day chart by mid-morning. The price then moved back up into the range however volumes remained extremely low and with the recent series of inside days reducing enthusiasm from all but the hardiest there was no sign of the market moving from said range as the Americas day commenced without notice. Mid-afternoon did see a small push which extended the high to $610.40, but the move felt rather token, and it was not long before the rangebound drift resumed. The one area showing movement was the white premiums where despite limited activity gains were recorded down the board March/March’24 reaching $143, May/May’24 to $139.00 and Aug/Jul’24 to $135.00. The final part of the afternoon saw price action confined to the range though buying during the last hour ensured a higher settlement prices down the board, March’24 valued at $607.10 as the sequence of inside days this week is maintained.