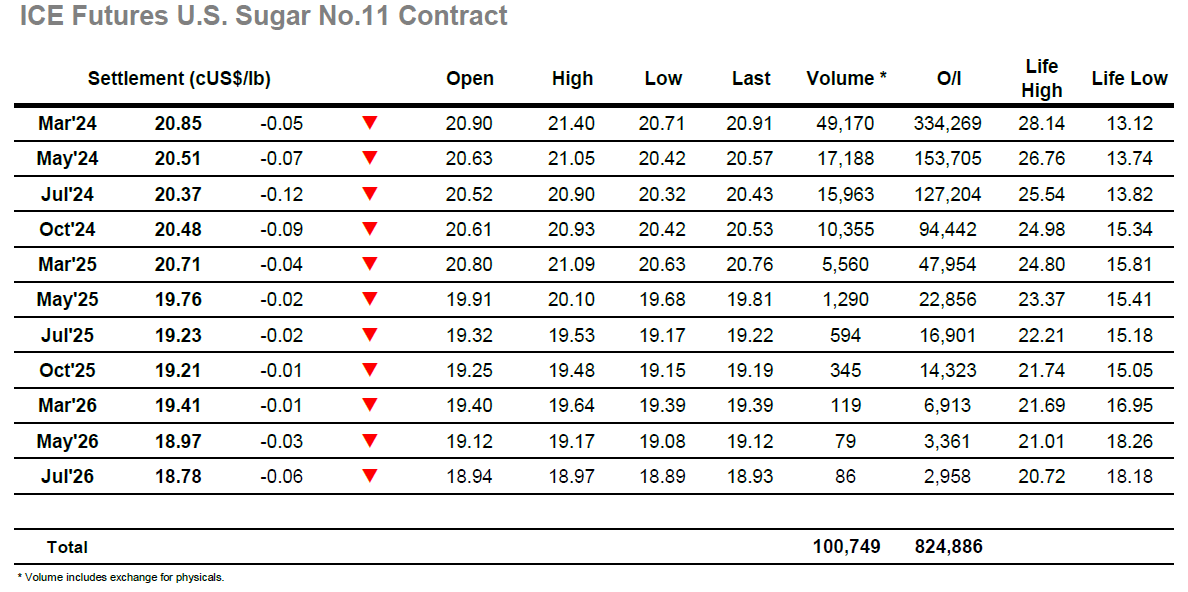

An unchanged opening felt appropriate following yesterday’s rather non-descript start to the year, and morning trading was again quiet though what interest we did see from consumers and specs did serve to nudge March’24 back above 21.00. By late morning values were holding in the teens and this served to encourage some additional spec interest which helped March’24 up to 21.40 around the start of the US day though an immediate collapse followed with liquidation sending the value rapidly back to unchanged. With the environment still featureless the picture soon calmed, and a period of sideways trading followed wither side of 21.00 with most potential participants not prepared to engage in such an illiquid market. It was only during the final two hours that a move to fresh ground was made with the range extended lower on some light day trader selling as they looked to see if the failure to rally would instigate any fresh selling, though this only dropped the price to 20.71 before short covering took place. This left the market sratching around the lower end of the range for the final stages, with a settlement reached at 20.85 to maintain the current stalemate.

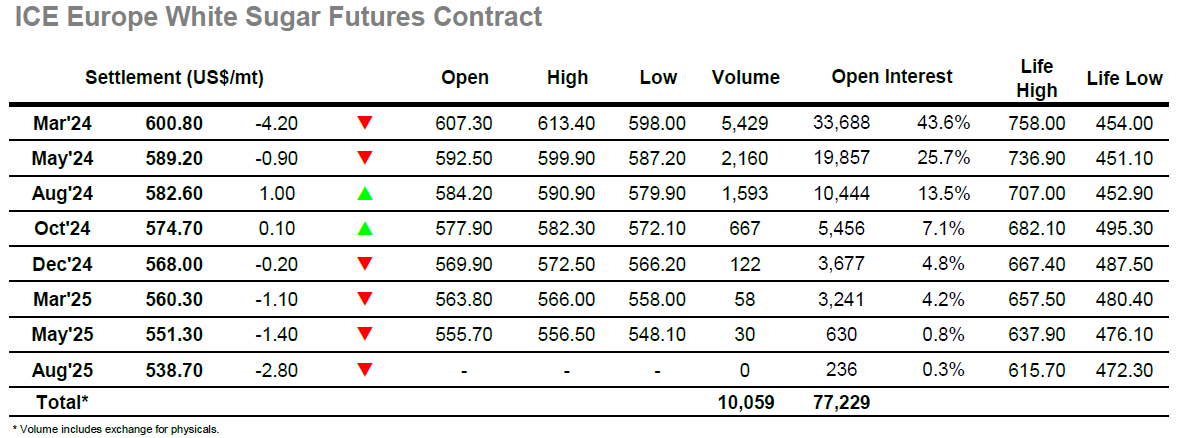

The market picked straight back up from where we had left off last night with a calm morning of rangebound trading seeing March’24 track along either side of unchanged levels. It was an uninspiring showing but despite this the market gradually attracted a little more buying to pish upwards around noon and reached a high at $613.40 before falling back sharply against day trader liquidation to again emphasise the lack of resting orders around current levels. The market then settled back down to repeat the morning pattern, though interestingly the March’24 spreads were giving back yesterday’s gains, and this may have discouraged byers as the market subsequently looked to test out the lower side. The decline extended to $598.00 and in addition to March/May’24 values at $10.60 there was also a weakening of the March’24 white premium to $140.00, though the premium values for the rest of the board were mostly unaffected. Final trades were to the bottom of the range with a weaker settlement made for March’24 to conclude a generally slow inside day.