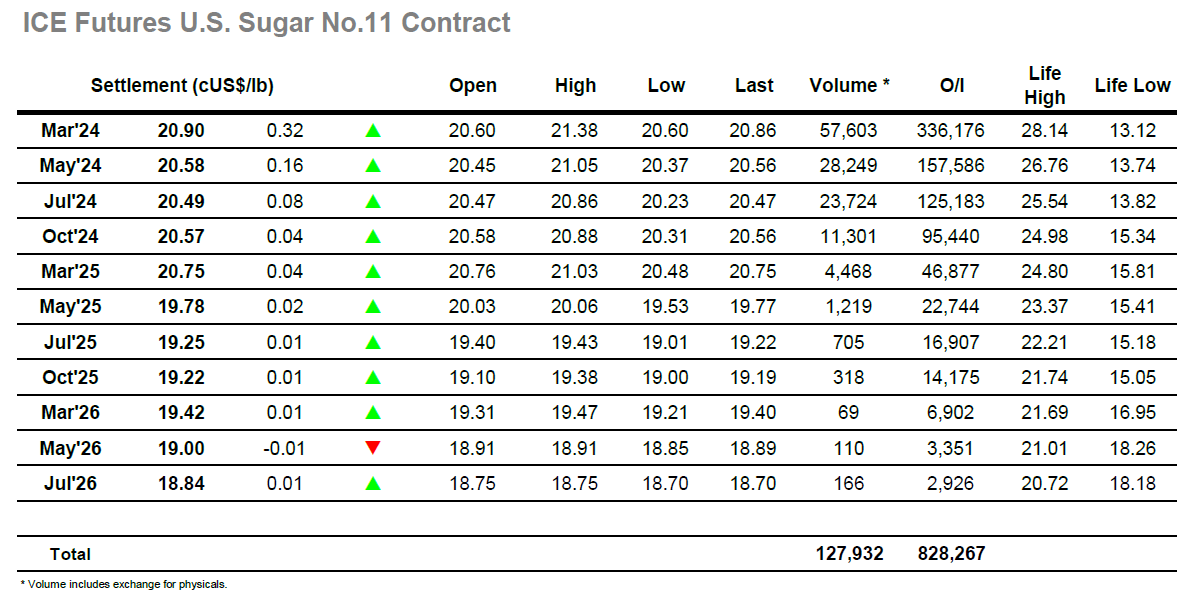

The new year got underway with a price lift to 21.02 for the March’24 contract, though in the context of the cataclysmic market performance during December such gains mean little, and the market duly gave much of them back when the initial hedge lifting had concluded. This led to a morning of subdued trading where prices tracked along within the range, many traders happy for this scenario to play out as the market celebrates the minor milestone of making it one calendar week since recording the low for the decline. Such milestones will provide hope that fall may have ended for now, though the wild daily movements seen last week will still provide concern and likely deter any potential buyers from showing much aggression. The market did manage to pull higher again with assistance from US specs as the lack of resting selling allowed an easy passage up to 21.38, however as with so many recent moves there was no substance and the market once more retreated into the range. The one positive through the rangebound trading was the March/May’24 spread as it held near to the 0.35 point high to maintain most of its gains, eventually settling at 0.32 points despite some late position squaring. This sent the flat price back below 21.00 and left March’24 closing at 20.90, modest gains to begin 2024 but with no sign as yet that the market wants to bounce very far.

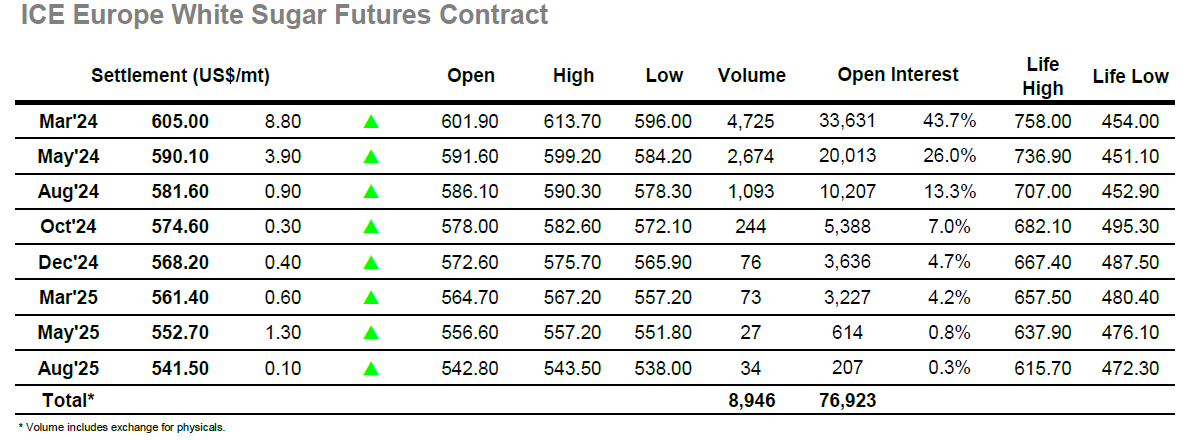

Following an extremely poor performance throughout December which led values to a weak year end the market resumed with a small element of positive movement as March’24 pushed back above $600.00. There was no significant early momentum however and so as the morning progressed the price slowly edged back to overnight levels to bring questions once more as to whether the downside may be resumed. These were put to bed (for today at least) during the early afternoon when buying from the Americas generated some fresh upside movement, extending the price through the morning highs and on to $613.70 despite only light volumes changing hands. The flat price interest was firmly centred around the spot month as befits spec led movement, and so against limited selling there was also a widening for the March’24 spreads with March/May’24 reaching a daily high at $14.90. In a featureless environment it was proving tricky to maintain the highs and so there was a slide back into the range against long liquidation with prices settling down in the $606.00 area to maintain a creditable $10 gain. This was maintained through to the end of the session though some final position squaring meant a March’24 settlement at $605.00.