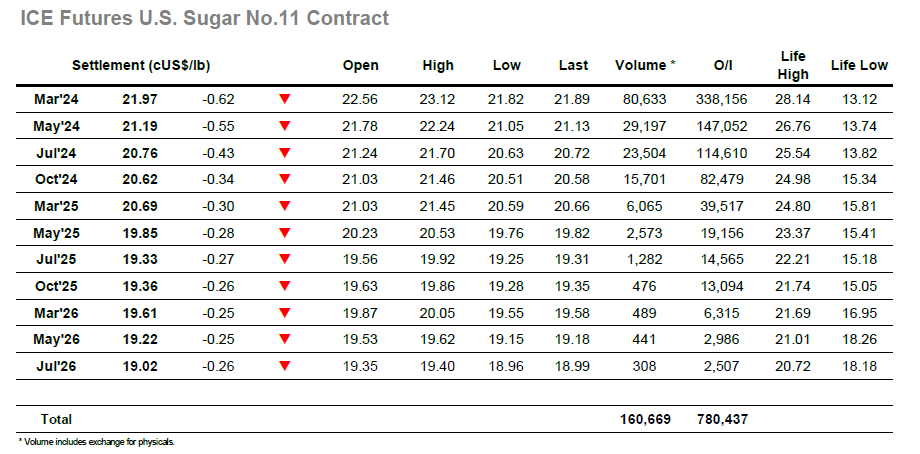

There is no such thing as a calm day in the current environment, however the day started about as calmly as is possible with first part of the morning seeing March’24 claw back some early losses to climb to 22.83 against a combination of consumer pricing and day trader interest. This in turn provided the basis for some braver spec buying to appear and give the market a nudge up beyond 23c, ending the morning with highs at 23.12 and taking on the most positive appearance seen for a while. It was short-lived though and once the US day commenced with no fresh buying on show the market started to turn lower with initial long liquidation wiping out much of the net gain and setting the trend lower once more. By mid-afternoon, the early lows were broken and suddenly there were few buyers to be found which enabled the price to continue slipping despite only modest volumes changing hands. A small burst of short covering provided the only blip on the way to 22.00 and with the market again looking weak some more aggressive probing from specs saw new session lows registered at 21.82 ahead of the close. There was naturally some late position squaring which meant a close away from the lows at 21.97, and while the movement so far this month would ordinarily be considered sufficient for some kind of consolidation at the least there is so far no evidence that we are ready with work still to be done if bottoming action is to occur rather than repeat a pattern seen twice already on the journey south.

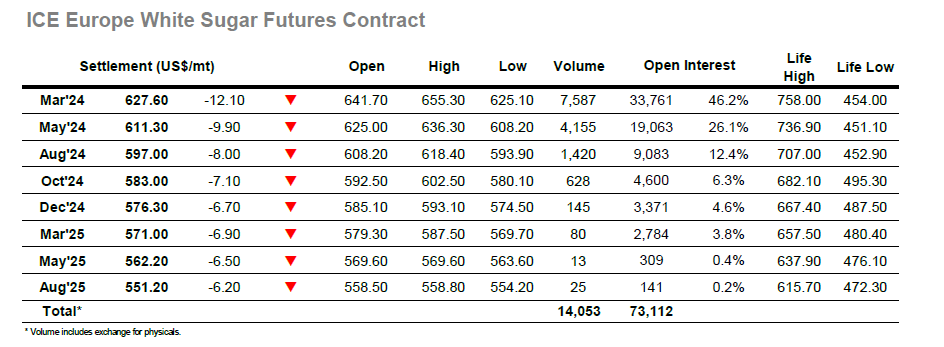

Higher opening prints were not sustained, and the market saw movement either side of overnight levels during the first 30 minutes of the day with most traders remain unsure as to the path forward in the current volatile environment. The current area is continuing to draw out pricing from consumers/end users and it was this which provided a stable base through a calm morning and allowed March’24 to hold the lower $640’s on low volumes. By late morning, this base drew in some new buying from smaller specs, enabling the market o work through what little selling was in place and reach $655.30, though it then became apparent that when they had bought sufficient size there were few willing to continue the push. Instead, the market started to retrace the rally with a calm path being taken back down to the morning lows and continuing beyond. The afternoon decline extended to $630.00 before stabilising, all taking place in an orderly manner which defied the fact that we had seen another sizable $25 daily range. Through this flat price movement, the white premium values were proving to be fairly robust with March/March’24 continuing along around $143.00, while nearby spread losses were in keeping with the spot month pressure as March/May’24 dipped to $15.70. The closing stages saw a further drop to $625.10, and with settlement made at $627.60 there is no sign that the current move has yet ended.