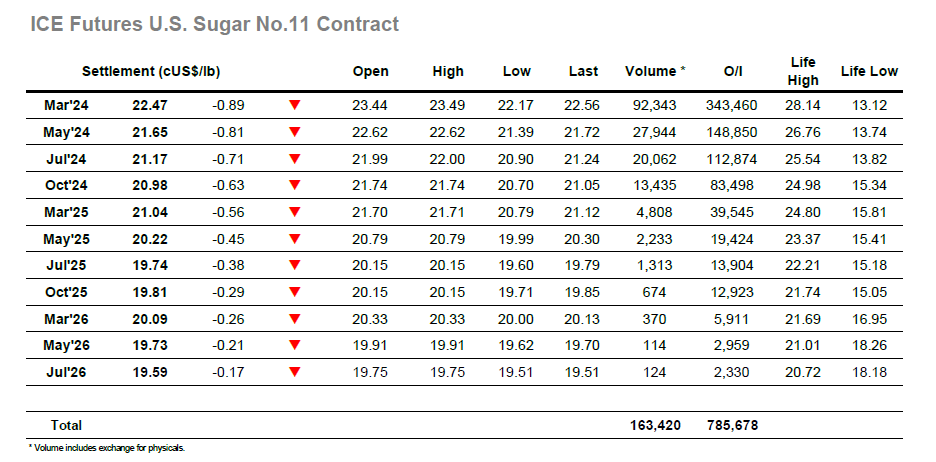

Today No.11 market opened at 23.44, 8 points above Friday’s settlement. Initial enthusiasm was not sustained long enough, as just after opening market saw 20 points drop. From that time until 10am, market kept trading sideways around 23.17. Aggressive liquidations followed with substantial volumes being traded plunging market to below 23c, ending its downside move to trade at the 22.60 zone. Few price fluctuations were seen until 3pm, when sellers pushed market down again, with a steady decline towards 23.50s. Further liquidations were seen half an hour before closing, when daily low was registered with market trading at 22.17. At this point market was down 119 points and buyers enjoyed the opportunity contributing to some correction to 22.50 zone. Settlement price was 22.47, representing a 89 points down move. Volume traded was sill big at 92k lots and H4K4 spread weakened to 82 points. Today’s settlement marks lowest settlement since late June.

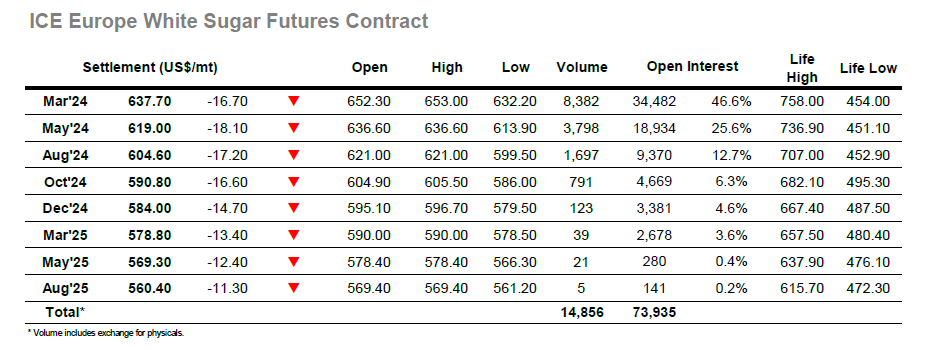

Today whites market opened at 652.3, down $2.1 from Friday’s settlement. Lateral trading was seen during the morning until 10am, when big liquidations plunged the market to trade at the $643 zone. That trading level was consistently seen until 2pm, when more selling activity started to be registered again, slowly forcing prices down. At 4pm, market saw another stronger selling wave which led market to the daily low at $632.2. Some recovery was seen in the last half an hour of trading leaving market to close at $640.3. Settlement price was $637.7, a -$16.7 move. Volume traded was 8.4k lots and H4H4 WP closed at $143.