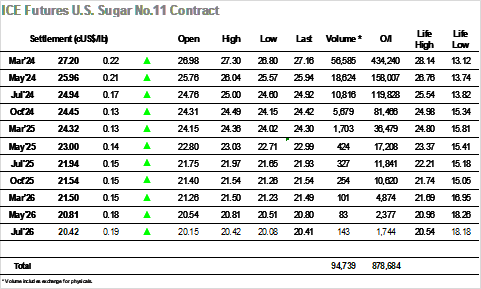

Opening prints at unchanged were quickly forgotten as selling appeared to push prices lower once again with March’24 quickly slipping a point beneath Fridays low as it traded to 26.80. The market then dug in to find support from consumer pricing which saw values tracking just ahead of this low for much of the morning before pulling back towards 27c ahead of the US day on some short covering. The underlying support had galvanised specs to push back up through 27c during the early afternoon, leaving the market in a slightly healthier position ahead of the UNICA announcement for the first half of November, This came in near to most estimates and showed 34.772mmt cane / 2.190mmt sugar / 49.81% mix / 132.69 kg/t ATR. Initially the market dipped back towards 27c however the specs were showing some enthusiasm for the upside and a sharp push up to 27.29 followed soon afterwards. The move did not appear to be based on any news, and so as the buying eased the market returned to track within the range where it remained until the final hour. The underlying support is a likely reason for the change of approach by small traders and during late trading they achieved a marginal new high at 27.30 though late position squaring meant a settlement at 27.20 with a continuation of the range for the time being.

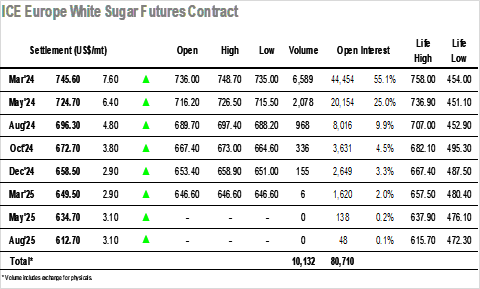

A relatively calm start to the week saw March’24 drift down to sit ahead of $735.00 on low volume, near term sentiment meaning that buyers were few and far between aside from the usual array of end user scales. With the picture proving to be stable the market started to tick back upwards by the end of the morning, maintaining the trend beyond noon to place March’24 back into the $740’s and away from the lows. This was providing some assistance to the spread and white premium values which were improving from their morning levels on the back of the buying/short covering being seen in the spot month. A spike to $748.70 followed midway through the afternoon on good volume with buy stops triggered along the way, and though there was a retreat soon afterwards the trend remained positive for the rest of the session. March’24 tracked back to the highs before settling at $745.60 following some late position squaring, With March/May’24 still steady at $20.90 and the March’24 white premium valued at $146.00.