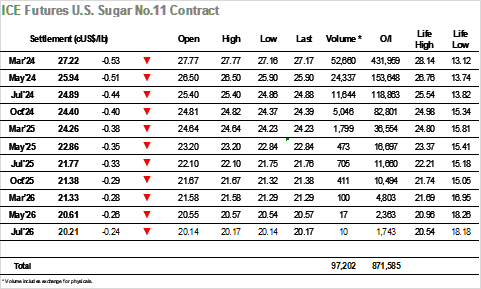

The day started calmly with March’24 initially trading either side of overnight levels and though the price settled into a tight range near to 27.70 to be showing minor losses the picture was calm and the bulls will have been content. Prices slipped a little further during the late morning however returned towards 24.70 as the US day got underway with the market seeming set to challenge the overhead resistance once more. Such thoughts were extinguished soon afterwards as the market instead plunged; confidence being eroded around markets on the back of a 4% collapse in crude values which occurred on news of the OPEC+ meeting being delayed. It was only around 27.30 that some end user support began to emerge with specs having been trying to liquidate into the vacuum that preceded, a sore way for their efforts of this week to end. The support endured for the rest of the afternoon as things settled, though with confidence now shot the market was slowly eroding to move nearer to last weeks support area. By the close prices had dropped the low 27.20’s with settlement made at 27.22, while post close trades down to a session low 27.16 send the market into tomorrow’s Thanksgiving holiday on the back foot.  A more positive environment this week have seen the March’24 contract climbing back up through this month’s range, and that mood was maintained through initial trading today as the price moved to a new 2-week high at $751.00. There was limited continuation buying though and so a morning of low volume consolidation ensued in the upper $740’s with longs looking for a continuation of the recent spec support to maintain the momentum. All remained calm into the early afternoon when in an instant (and in line with the sector / led by crude) the market saw a $7 correction. Support was suddenly hard to find as spec longs headed for the exit, albeit with limited success due to a lack of buying depth, and it was only in the lower $740’s that consumer pricing was seen to provide more substantial buying. A calmer environment then endured for the rest of the session with several hours spent within a narrow band, though the damage had been done and so the price eased further late on to a session low at $740.00. Settlement at $740.90 removes all recent gloss, and with No.11 closed tomorrow there is scope for the whites to dictate the near-term direction in their absence.

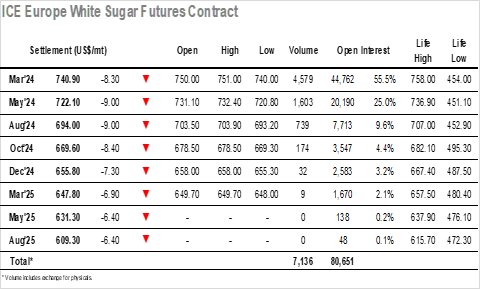

A more positive environment this week have seen the March’24 contract climbing back up through this month’s range, and that mood was maintained through initial trading today as the price moved to a new 2-week high at $751.00. There was limited continuation buying though and so a morning of low volume consolidation ensued in the upper $740’s with longs looking for a continuation of the recent spec support to maintain the momentum. All remained calm into the early afternoon when in an instant (and in line with the sector / led by crude) the market saw a $7 correction. Support was suddenly hard to find as spec longs headed for the exit, albeit with limited success due to a lack of buying depth, and it was only in the lower $740’s that consumer pricing was seen to provide more substantial buying. A calmer environment then endured for the rest of the session with several hours spent within a narrow band, though the damage had been done and so the price eased further late on to a session low at $740.00. Settlement at $740.90 removes all recent gloss, and with No.11 closed tomorrow there is scope for the whites to dictate the near-term direction in their absence.

Daily Market Price Updates and Commentary 22nd November 2023

Related content

Daily Market Price Updates and Commentary 28th November 2024

There was significant movement through the early part of the se...

Strong Flows of Liquid Sugar to China Continue

Insight Focus The 2024/25 season got off to a strong start with record...

Daily Market Price Updates and Commentary 27th November 2024

Yesterday’s bounce has reinvigorated some buying interest and th...

India: Sugar vs Ethanol? 27th November 2024

Insight Focus Domestic sugar prices have traded between INR 35,200-36,...

CS Brazil: Sugar or Ethanol? 27th November 2024

This report is updated weekly, for daily information refer to our Busi...

Daily Market Price Updates and Commentary 26th November 2024

Following a week of struggle which has seen prices working back down t...

Focus Shifts to 2025 After Challenging Australian Cane Crush Season

Insight Focus The 2024 crush season faced challenges due to record-bre...

Minor Impacts from GLP-1s, Reformulations Seen in US Sugar Market

This update is from Sosland Publishing’s Sweetener Report. For more ...

Want to learn more about Sugar

The Raw Sugar Futures July-October Spread

Welcome to the sixth instalment of Czapp’s course on futures market ...

The Raw Sugar Futures May-July Spread

Welcome to the fifth instalment of Czapp’s course on futures mar...

The Raw Sugar Futures March-May Spread

Welcome to the fourth instalment of Czapp’s course on futures market...

The Raw Sugar Futures October-March Spread

Welcome to the third instalment of Czapp’s course on futures market ...

Biomass: The Future of Renewable Energy

What is Biomass? Biomass is a fuel derived from organic material such ...

What Factors Influence Futures Market Spreads?

Welcome to the second instalment of Czapp’s course on futures ma...

Identifying Relationships in Commodities With Machine Learning

Insight Focus We have used machine learning to research commodity mark...

What is the Carbon Border Adjustment Mechanism?

Insight Focus Importers of carbon-intensive materials to the EU will p...