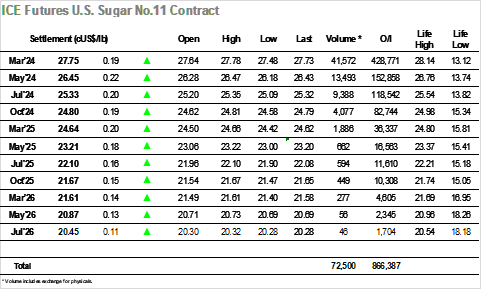

Having finally shaken away from the teens with yesterday’s rally the market continued to show firmly with modest buying extending the March’24 price to 24.71 during the early part of the morning. The price held form for a period though the problem for bulls remains the depth of buying at the higher levels with small trader selling kicking March’24 back down to 27.48 by the end of the morning. Hedge funds remain absent from proceedings but despite their lack of interest in adding to longs the smaller specs and algos were soon pushing ahead once more, their next efforts bringing marginal new session highs as they tested into scale selling. March’24 topped out at 27.75 with the buyers starting to wane once again, however such is the desire to test higher that there was only more limited liquidation seen with consolidation then seen in the upper section of the daily range. Hopes are being pinned upon receiving additional positive news from India and Brazil and should that happen it seems that a test to 28.14 would be a formality, though in the meantime sustained progress may prove to be trickier. Having seen some traders closing longs back out there was an inevitability about the closing push to a session high 27.78 to ensure another solid settlement, recorded at 27.75, which will provide momentum to try and maintain the push into Thanksgiving.  The whites have unleashed back into some life this week and following some early volatility there was again buying filtering through which pushed March’24 into the upper $740’s despite lacking significant size. This ensured a stability was maintained through the next couple of hours, though in keeping with recent movements it was not proving to be a one-way path and by late morning some profit taking from day traders set the market back into net deficit. Volumes remain light following the Dec’23 expiry, a normal factor for this time of year, but that was not deterring day traders from pursuing the upside in hope of a technical break that could bring in more sustained buying and provide greater opportunity. To this end their persistence saw March’24 climb to a session high at $750.00 late in the afternoon which matched the high from 10th November, though crucially it was unable to push beyond as they would have wanted. Instead, the final hour therefore drew yet another round of liquidation/position squaring, though not all longs were heading for the exit with others returning to insure a positive settelemht was made. March’24 duly closed at $749.20 due to their efforts ensuring the picture remain positive for another day.

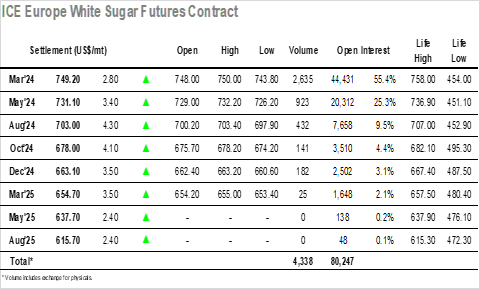

The whites have unleashed back into some life this week and following some early volatility there was again buying filtering through which pushed March’24 into the upper $740’s despite lacking significant size. This ensured a stability was maintained through the next couple of hours, though in keeping with recent movements it was not proving to be a one-way path and by late morning some profit taking from day traders set the market back into net deficit. Volumes remain light following the Dec’23 expiry, a normal factor for this time of year, but that was not deterring day traders from pursuing the upside in hope of a technical break that could bring in more sustained buying and provide greater opportunity. To this end their persistence saw March’24 climb to a session high at $750.00 late in the afternoon which matched the high from 10th November, though crucially it was unable to push beyond as they would have wanted. Instead, the final hour therefore drew yet another round of liquidation/position squaring, though not all longs were heading for the exit with others returning to insure a positive settelemht was made. March’24 duly closed at $749.20 due to their efforts ensuring the picture remain positive for another day.

Daily Market Price Updates and Commentary 21st November 2023

Become a Thought Leader on our App

Are you an industry expert in:

• Soybeans

• Grains

• Dairy

• Fruit

• Freight

• Orange Juice

• Nuts and Seeds

• Fertilisers

• Carbon

We’re looking for leading voices who want to contribute their expertise to a global audience.

Find out how a partnership with us works below.

Related content

Daily Market Price Updates and Commentary 17th April 2025

Raw Sugar Update Jul’25 pushed up by around 10 points during ear...

UK Farms Face Dry Conditions, Lack of Government Support

Insight Focus Dry weather and temperature fluctuations are affecting c...

Daily Market Price Updates and Commentary 16th April 2025

Raw Sugar Update The market has endured a torrid run over the past two...

US Sugar Disrupted by On-Off Import Tariffs

This update is from Sosland Publishing’s Sweetener Report. For more ...

CS Brazil: Sugar or Ethanol? 15th April 2025

This report is updated weekly, for daily information refer to our Busi...

Daily Market Price Updates and Commentary 15th April 2025

Raw Sugar Update It was another calm start to trading with this week s...

Daily Market Price Updates and Commentary 14th April 2025

Raw Sugar Update The week commenced with Jul’25 still sitting at...

Sugar Futures and Market Data: 14th April 2025

Insight Focus The raw sugar futures traded lower last week. Both produ...

Want to learn more about Sugar

The Raw Sugar Futures July-October Spread

Welcome to the sixth instalment of Czapp’s course on futures market ...

The Raw Sugar Futures May-July Spread

Welcome to the fifth instalment of Czapp’s course on futures mar...

The Raw Sugar Futures March-May Spread

Welcome to the fourth instalment of Czapp’s course on futures market...

The Raw Sugar Futures October-March Spread

Welcome to the third instalment of Czapp’s course on futures market ...

Biomass: The Future of Renewable Energy

What is Biomass? Biomass is a fuel derived from organic material such ...

What Factors Influence Futures Market Spreads?

Welcome to the second instalment of Czapp’s course on futures ma...

Identifying Relationships in Commodities With Machine Learning

Insight Focus We have used machine learning to research commodity mark...

What is the Carbon Border Adjustment Mechanism?

Insight Focus Importers of carbon-intensive materials to the EU will p...