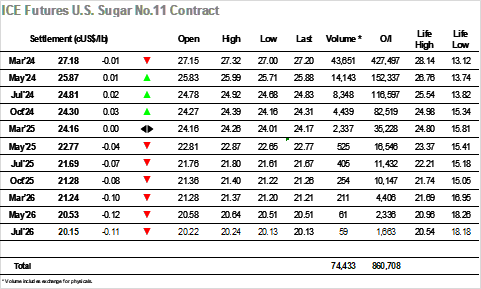

It was a very slow start to todays session with March’24 largely unchanged through the early morning, apathy clearly growing considering the uninspiring performance this week. Of course, there will always be interest from the day traders in trying to generate a move, and they duly arrived on the scene midway through the morning to push March’24 up to 27.32, though given the lack of resting sell orders that move felt poorly supported and it was to be expected that the price tracked lower again soon afterwards. There was no fresh appetite to do anything form the Americas and so the afternoon saw prices track along quietly within the range, appearing set for an inside day until a small burst of selling sent the price a tick beneath yesterdays low at 27.00. Much like the morning “rally” there was no hint of follow up interest to this move and so then status quo quickly resumed with the market idling towards the weekend. Even the spreads couldn’t find much volume today with the March/May’24 maintaining a tight 4-point band before ending the session unchanged at 1.31 points. March’24 was little changed once again, settling at 27.18 to taker us into a much-needed weekend.  March’24 has struggled to find any direction following the Dec’23 expiration and that situation showed no sign of changing today as prices ticked along on familiar ground. A morning nudge up to $737.60 was all we had to show from some light speculative efforts and with volume becoming lower by the day it is difficult to see where the next move comes from pending fresh news. Ordinarily the Americas day would bring a little more activity to the environment but here too there is limited interest and so the sideways pattern endured, with a small dip to $731.00 not challenging yesterdays lows and so presenting the likelihood of an inside day. Even the spreads could not muster any real interest, and with less than an hour of the session remaining March/May’23 had seen fewer that 300 lots change hands. The only question was whether any pre-weekend posturing may bring some late interest, and a little buying did emerge to send values out at the highs, closing at $736.60.

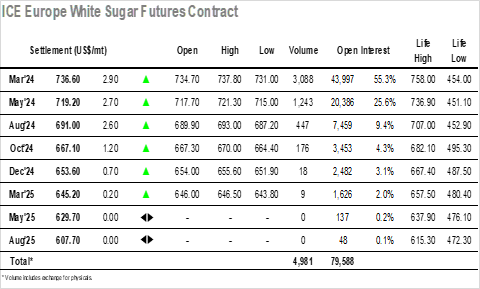

March’24 has struggled to find any direction following the Dec’23 expiration and that situation showed no sign of changing today as prices ticked along on familiar ground. A morning nudge up to $737.60 was all we had to show from some light speculative efforts and with volume becoming lower by the day it is difficult to see where the next move comes from pending fresh news. Ordinarily the Americas day would bring a little more activity to the environment but here too there is limited interest and so the sideways pattern endured, with a small dip to $731.00 not challenging yesterdays lows and so presenting the likelihood of an inside day. Even the spreads could not muster any real interest, and with less than an hour of the session remaining March/May’23 had seen fewer that 300 lots change hands. The only question was whether any pre-weekend posturing may bring some late interest, and a little buying did emerge to send values out at the highs, closing at $736.60.

Daily Market Price Updates and Commentary 17th November 2023

Become a Thought Leader on our App

Are you an industry expert in:

• Soybeans

• Grains

• Dairy

• Fruit

• Freight

• Orange Juice

• Nuts and Seeds

• Fertilisers

• Carbon

We’re looking for leading voices who want to contribute their expertise to a global audience.

Find out how a partnership with us works below.

Related content

Daily Market Price Updates and Commentary 17th April 2025

Raw Sugar Update Jul’25 pushed up by around 10 points during ear...

UK Farms Face Dry Conditions, Lack of Government Support

Insight Focus Dry weather and temperature fluctuations are affecting c...

Daily Market Price Updates and Commentary 16th April 2025

Raw Sugar Update The market has endured a torrid run over the past two...

US Sugar Disrupted by On-Off Import Tariffs

This update is from Sosland Publishing’s Sweetener Report. For more ...

CS Brazil: Sugar or Ethanol? 15th April 2025

This report is updated weekly, for daily information refer to our Busi...

Daily Market Price Updates and Commentary 15th April 2025

Raw Sugar Update It was another calm start to trading with this week s...

Daily Market Price Updates and Commentary 14th April 2025

Raw Sugar Update The week commenced with Jul’25 still sitting at...

Sugar Futures and Market Data: 14th April 2025

Insight Focus The raw sugar futures traded lower last week. Both produ...

Want to learn more about Sugar

The Raw Sugar Futures July-October Spread

Welcome to the sixth instalment of Czapp’s course on futures market ...

The Raw Sugar Futures May-July Spread

Welcome to the fifth instalment of Czapp’s course on futures mar...

The Raw Sugar Futures March-May Spread

Welcome to the fourth instalment of Czapp’s course on futures market...

The Raw Sugar Futures October-March Spread

Welcome to the third instalment of Czapp’s course on futures market ...

Biomass: The Future of Renewable Energy

What is Biomass? Biomass is a fuel derived from organic material such ...

What Factors Influence Futures Market Spreads?

Welcome to the second instalment of Czapp’s course on futures ma...

Identifying Relationships in Commodities With Machine Learning

Insight Focus We have used machine learning to research commodity mark...

What is the Carbon Border Adjustment Mechanism?

Insight Focus Importers of carbon-intensive materials to the EU will p...