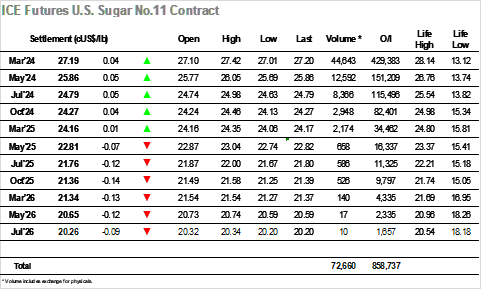

There was immediate pressure applied to No.11 with March’24 pushed down to a new 2-week low at 27.01 following the opening, though buying quickly kicked in to defend the 27 handle, The turnaround over the next two hours was stark with March’24 finding new support from day traders to reach 27.42, the market suitably encouraged by their buying to maintain the rally and remain within proximity of the highs as noon approached. The recent problems then manifested however with the funds showing no desire to join the buying, and so as the US morning got underway the losses eroded away to leave the market back around overnight levels and feeling directionless. This led to a malaise through the following hours with light efforts to push in either direction failing to garner the support needed to break beyond morning parameters, leaving the hours to tick by slowly. All remained quiet heading into the close, and while some late buying saw a marginally higher close at 27.19 it marks a third successive settlement value in the teens while the market searches for its next movement.  March’24 began its tenure at the top of the board with some choppy trading either side of overnight levels, though this in itself will have been welcomed by longs with there being no immediate sign that we would continue the lower path set so far this week. Increasingly it became the upside that was attracting the interest with March’24 moving up to $739.70, though the higher levels proved to be short-lived as the lack of more meaningful buying saw the move wane. This allowed values to retreat to the morning range and on limited volume the picture calmed until mid-afternoon when some fresh selling emerged in an effort to test yesterday’s lower levels and generate fresh movement. Lows were registered at $730.30 as the efforts failed to test $729.00, and with news lacking and interest dropping away things quickly calmed to leave the final hours spent tracking quietly sideways. Though the movements there was a firmer showing from the white premiums with March/March’24 holding around $135.00, though here also the volumes were minimal. Light closing buying (position squaring) minimised the losses and ensured a settlement away from the lows at $733.70. As expected, a total of 5,255 lots (262,750mt) was tendered against the Dec’23 expiry.

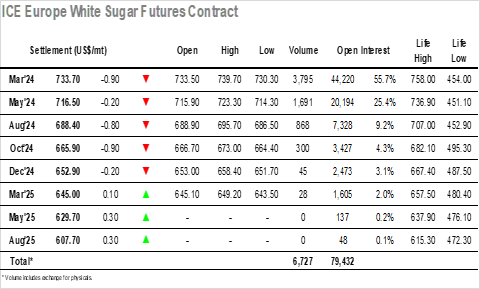

March’24 began its tenure at the top of the board with some choppy trading either side of overnight levels, though this in itself will have been welcomed by longs with there being no immediate sign that we would continue the lower path set so far this week. Increasingly it became the upside that was attracting the interest with March’24 moving up to $739.70, though the higher levels proved to be short-lived as the lack of more meaningful buying saw the move wane. This allowed values to retreat to the morning range and on limited volume the picture calmed until mid-afternoon when some fresh selling emerged in an effort to test yesterday’s lower levels and generate fresh movement. Lows were registered at $730.30 as the efforts failed to test $729.00, and with news lacking and interest dropping away things quickly calmed to leave the final hours spent tracking quietly sideways. Though the movements there was a firmer showing from the white premiums with March/March’24 holding around $135.00, though here also the volumes were minimal. Light closing buying (position squaring) minimised the losses and ensured a settlement away from the lows at $733.70. As expected, a total of 5,255 lots (262,750mt) was tendered against the Dec’23 expiry.

Daily Market Price Updates and Commentary 16th November 2023

Become a Thought Leader on our App

Are you an industry expert in:

• Soybeans

• Grains

• Dairy

• Fruit

• Freight

• Orange Juice

• Nuts and Seeds

• Fertilisers

• Carbon

We’re looking for leading voices who want to contribute their expertise to a global audience.

Find out how a partnership with us works below.

Related content

Daily Market Price Updates and Commentary 17th April 2025

Raw Sugar Update Jul’25 pushed up by around 10 points during ear...

UK Farms Face Dry Conditions, Lack of Government Support

Insight Focus Dry weather and temperature fluctuations are affecting c...

Daily Market Price Updates and Commentary 16th April 2025

Raw Sugar Update The market has endured a torrid run over the past two...

US Sugar Disrupted by On-Off Import Tariffs

This update is from Sosland Publishing’s Sweetener Report. For more ...

CS Brazil: Sugar or Ethanol? 15th April 2025

This report is updated weekly, for daily information refer to our Busi...

Daily Market Price Updates and Commentary 15th April 2025

Raw Sugar Update It was another calm start to trading with this week s...

Daily Market Price Updates and Commentary 14th April 2025

Raw Sugar Update The week commenced with Jul’25 still sitting at...

Sugar Futures and Market Data: 14th April 2025

Insight Focus The raw sugar futures traded lower last week. Both produ...

Want to learn more about Sugar

The Raw Sugar Futures July-October Spread

Welcome to the sixth instalment of Czapp’s course on futures market ...

The Raw Sugar Futures May-July Spread

Welcome to the fifth instalment of Czapp’s course on futures mar...

The Raw Sugar Futures March-May Spread

Welcome to the fourth instalment of Czapp’s course on futures market...

The Raw Sugar Futures October-March Spread

Welcome to the third instalment of Czapp’s course on futures market ...

Biomass: The Future of Renewable Energy

What is Biomass? Biomass is a fuel derived from organic material such ...

What Factors Influence Futures Market Spreads?

Welcome to the second instalment of Czapp’s course on futures ma...

Identifying Relationships in Commodities With Machine Learning

Insight Focus We have used machine learning to research commodity mark...

What is the Carbon Border Adjustment Mechanism?

Insight Focus Importers of carbon-intensive materials to the EU will p...