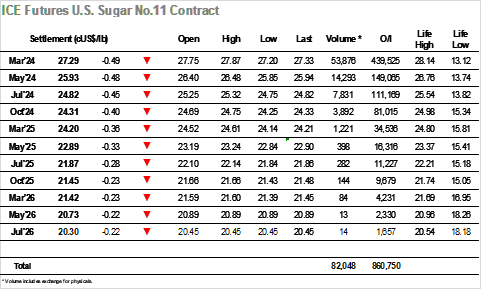

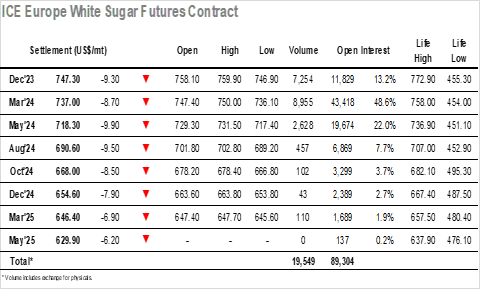

Today No.11 opened at 27.75, 3 points below yesterday’s settlement. During the morning, trading activity was small, and market traded slightly down towards 27.65 un 1pm. Just after America’s opening market saw more volume and selling pressure brought market down. By 1h30pm, trading levels were at 27.50, one hour later, further liquidation made market drop to 27.30. Sideways movements were seen from 3 pm until closing, with market ending the week at 27.33. Settlement price was 27.29, 49 points down from previous settlement. Volume traded was 55k lots. Today, Dec’23 opened at $758.1, experiencing an increase of $1.5 USD/Mt. In the first 30 minutes, the market was able to maintain the opening levels with short movements between $756 and $759. In the last Friday before the expiry Dec’23 remained stable for the next few hours, trading above $756 and below $760. Around 13:00h, a downward movement emerged, causing Dec ’23 prices to decline in the following hours. This trend persisted until the market closed, following the NY#11 prices, with the low at 746. 90 minutes before the end of the market and led the settlement price to close at $747.3, a decrease of -$9.3 from yesterday’s settlement and a -1.23% change from the previous session. Dec’23 recorded a volume of 7k lots, and the Z3/H4 spread closed at +10.3.

Today, Dec’23 opened at $758.1, experiencing an increase of $1.5 USD/Mt. In the first 30 minutes, the market was able to maintain the opening levels with short movements between $756 and $759. In the last Friday before the expiry Dec’23 remained stable for the next few hours, trading above $756 and below $760. Around 13:00h, a downward movement emerged, causing Dec ’23 prices to decline in the following hours. This trend persisted until the market closed, following the NY#11 prices, with the low at 746. 90 minutes before the end of the market and led the settlement price to close at $747.3, a decrease of -$9.3 from yesterday’s settlement and a -1.23% change from the previous session. Dec’23 recorded a volume of 7k lots, and the Z3/H4 spread closed at +10.3.

Daily Market Price Updates and Commentary 10th November 2023

Become a Thought Leader on our App

Are you an industry expert in:

• Soybeans

• Grains

• Dairy

• Fruit

• Freight

• Orange Juice

• Nuts and Seeds

• Fertilisers

• Carbon

We’re looking for leading voices who want to contribute their expertise to a global audience.

Find out how a partnership with us works below.

Related content

Daily Market Price Updates and Commentary 17th April 2025

Raw Sugar Update Jul’25 pushed up by around 10 points during ear...

UK Farms Face Dry Conditions, Lack of Government Support

Insight Focus Dry weather and temperature fluctuations are affecting c...

Daily Market Price Updates and Commentary 16th April 2025

Raw Sugar Update The market has endured a torrid run over the past two...

US Sugar Disrupted by On-Off Import Tariffs

This update is from Sosland Publishing’s Sweetener Report. For more ...

CS Brazil: Sugar or Ethanol? 15th April 2025

This report is updated weekly, for daily information refer to our Busi...

Daily Market Price Updates and Commentary 15th April 2025

Raw Sugar Update It was another calm start to trading with this week s...

Daily Market Price Updates and Commentary 14th April 2025

Raw Sugar Update The week commenced with Jul’25 still sitting at...

Sugar Futures and Market Data: 14th April 2025

Insight Focus The raw sugar futures traded lower last week. Both produ...

Want to learn more about Sugar

The Raw Sugar Futures July-October Spread

Welcome to the sixth instalment of Czapp’s course on futures market ...

The Raw Sugar Futures May-July Spread

Welcome to the fifth instalment of Czapp’s course on futures mar...

The Raw Sugar Futures March-May Spread

Welcome to the fourth instalment of Czapp’s course on futures market...

The Raw Sugar Futures October-March Spread

Welcome to the third instalment of Czapp’s course on futures market ...

Biomass: The Future of Renewable Energy

What is Biomass? Biomass is a fuel derived from organic material such ...

What Factors Influence Futures Market Spreads?

Welcome to the second instalment of Czapp’s course on futures ma...

Identifying Relationships in Commodities With Machine Learning

Insight Focus We have used machine learning to research commodity mark...

What is the Carbon Border Adjustment Mechanism?

Insight Focus Importers of carbon-intensive materials to the EU will p...