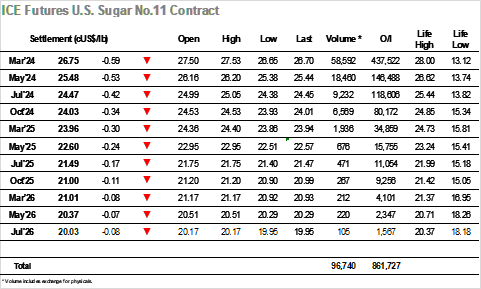

Today No.11 opened at 27.50, in a +16 points gap from Friday’s settlement. Daily high was reached few moments later at 27.53, when market started to realize some gains and negative sentiment dominated the session. By 9h30 am market was down trading at 27.13, the next hour registered a recovery attempt the 27.30 but soon eroded and further selling volumes brought market to trade around the 27c barrier. Sideways movement was then seen from 10h30 am until 2h30 pm, when more volumes were pushing the market further down. Around 3pm market was trading at 26.68 and half an hour later, daily low was recorder, with market trading at 26.65. Proceeding to the last trading, market drafted un upside correction to 26.85 but soon went down again to close valued at 26.70. Settlement price was 26.75, 59 points down from Friday’s settlement. Volume traded was around 59k lots and H4K4 spread weakened 6 points, trading at 1.27.

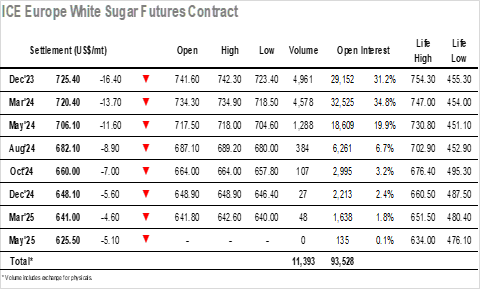

Today Whites market opened at $741.6, $0.2 up from Friday’s settlement. Daily high was registered few moments after the opening at $742.3 and marked soon started losing power due to macro commodities negative sentiment. By 9h30am, market was trading at$ 733.1, another bearish move followed in the next hour, and market traded sideways until 2h30pm around $731. Another sharp decline in prices was seen near 2h30pm and the daily low was registered an hour later, when it traded at $723.4. Closing price was just above the low at $724. And No.5 settled trading at $725.4, a -$16.4 move. Volume traded was around 5k lots and white premium closed at $130.77.