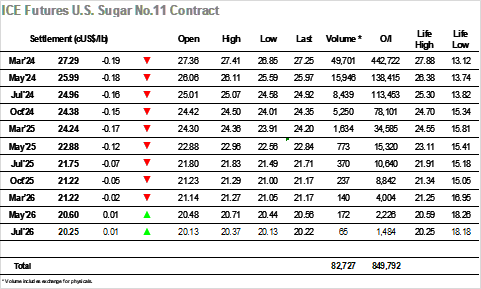

Today No.11 market opened at 27.36, 12 points below yesterday’s settlement. The opening gap continued putting a downward pressure into the market through the session. By 9am, No.11 was trading at 27.20. For the next 2 hours, sugar saw some further selling that lead the market to trade near 27.05. Around 12pm, there was a recovery attempt, when market came back to the 27.20 zone, but this was not enough and market saw more sellers acting in the next hour, when 2k lots of volume candles brought market to daily low, trading at 26.85. Another relief was seen around 3 pm and market traded again at 27.15. Around 5 pm, market again lost power and saw another swing back to the 26.90s. Some reaction followed near closing and market recovered closing at 27.25. Settlement price was 27.29, -0.19 points below yesterday’s settlement volume traded was 50k lots and H4K4 spread closed valued at 1.30 (-0.01).

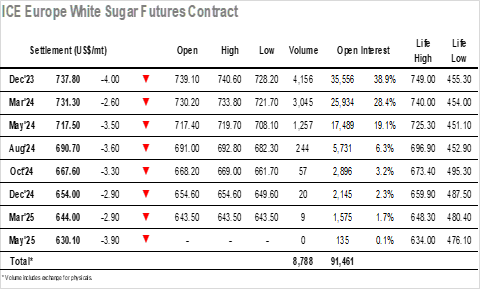

Today, Dec’23 moved in the opposite direction from the previous day’s opening, experiencing a decrease of $2.7 USD/Mt at $739.1. In the first 30 minutes, the market was able to maintain the opening levels but dropped below the $734 level shortly afterward. Dec’23 remained stable for the next few hours, briefly dipping below the $730 level just minutes before 2:00 pm when the market initiated an upward movement but lacked the strength to sustain it. In the last 30 minutes, the market surprised with a significant upward movement, pushing Dec’23 from $732 to levels above $740 for a brief period before the settlement. This final movement supported the settlement level a bit below the opening priced at $737.8, -4 from yesterday’s settlement and a -0.54% change from the previous session. Dec’23 registered 4K lots of volume, and the Z3/H4 spread closed at +$6.5.