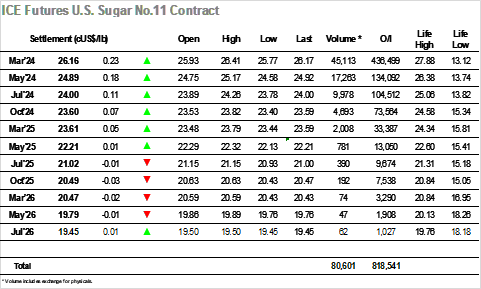

The past week has seen some volatility generated by specs and algos, but having pulled away from Tuesdays lows there was a somewhat calmer picture this morning with movements being confined to yesterday’s range. March’24 had rallied to 26.12 during the early morning before easing back to hold close to overnight levels, and with no fresh news on the horizon the market was subdued ahead of the Americas day commencing. Here too there was a subdued feel towards the market, though by mid-afternoon the buying efforts of day traders / specs / algos did help the market to surpass yesterday’s highs and reach 26.41. A small degree of producer pricing was seen on the rally however the window of opportunity for their pricing quickly passed and before long the March’24 price had declined towards 26c once again, driven by long liquidation. With the trade showing no interest in proceedings and the specs dusting themselves down, the remainder of the session played out very slowly to the centre of the range. There was the usual pre-close choppiness however it meant little and so the day concluded quietly with March’24 at 26.16, an area from which the longs will likely look to continue to consolidate tomorrow.

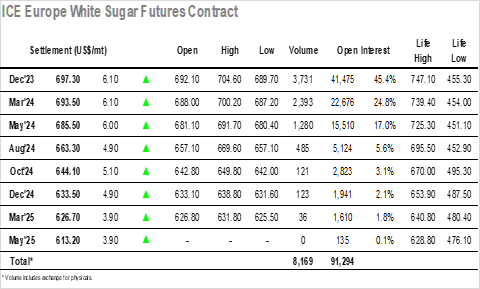

Light early hedge lifting enabled Dec’23 to rally up to $697.30 however the cover was soon taken and as the interest dissipated so the market eased back to sit calmly in the lower $690’s through into late morning. With no apparent interest from either side volume was running at very low levels and that remained the case through into the early afternoon despite a climb back away from the lows and through the early range. With so little happening to took another bout of spec led buying from the US to haul prices higher versus the white premiums, action which saw Dec’23 work briefly above yesterday’s highs and reach $704.60 before falling back. White premium values saw a little movement through this period though March/March’24 continued between $116 and $119, while for the spreads Dec’23/March’24 was showing little change. The remainder of the session played out calmly within the range, small trader activity causing slight movements but little more as Dec’23 meandered to a firmer close at $697.30 though the broader picture remains unchanged.