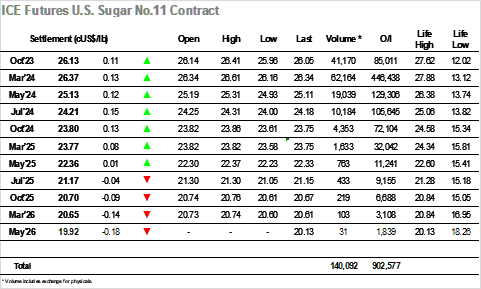

Pre-opening saw the market indicated more than 20 points higher, though in the event selling appeared and from opening prints around 10 points firmer the market quickly slipped down into the red. March’23 quickly touched a new recent low at 26.16, however the selling then eased, and the market was able to develop a consolidation pattern built upon underlying consumer pricing. On this movement the market did pull back to the positive, sitting either side of 26.30 for a few hours on low volume, awaiting the arrival of US traders to see whether they continued to apply pressure to the environment. The answer was a resounding no with the market simply continuing to tread broadly sideways, the only change being that it was within a marginally wider range on better volumes. It was only during the final couple of hours that some better interest sparked, with an element of spec buying attempting to bring the market higher, aided by the usual array of algo activity. March’24 reached 26.61 before falling back against long liquidation, suggesting that with a potential large Oct’23 tender still looming we are not yet ready to resume the upside. The pullback left March’24 back in the 26.30’s during the final stages, settling at 26.37 to show modest gains. Open interest fell, as expected, but remains high at 85,011 lots. Todays Oct’23 volume of almost 40,000 lots included some sizable AA’s which will bring this figure down again tomorrow, though for now a large delivery seems highly likely.

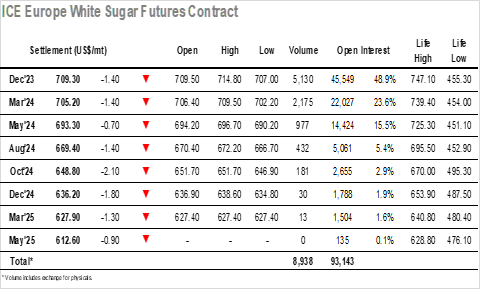

A choppy opening period saw Dec’23 pushing up to trade at $714.30, though it was not long before these gains eroded, and the price eased to sit in the vicinity of $710. Sideways movement (if you can call it that) then ensued for several hours, with the feeling that specs are nervous to enter the fray currently and require a little more direction to be in place before renewing activities. The next activity did not appear until mid-afternoon and it was the lower end of the range that was tested with selling sending the value down to $707.00. These losses came at the expense of the white premium values where lower values were being registered down the board with March/March’24 dropping as low as $122.50. From the lows we saw a sharp turnaround with a rally to new highs at $714.80, a move which owed more to the No.11 specs driving higher than anything else with the premiums remaining at their lows. The rally was not sustained and in keeping with this weeks trend the market pulled back down on liquidation, ending the day marginally weaker at $709.30 and continuing to appear vulnerable.