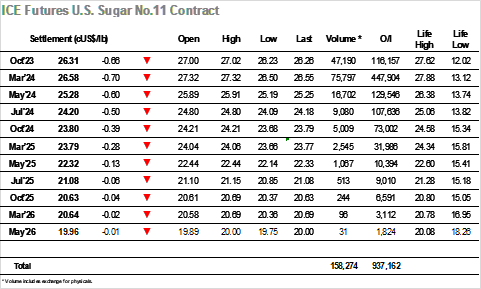

An unchanged opening soon gave way to marginal losses with March’24 slipping back to hold either side of 27.10 on moderate volumes. Friday evening’s COT report showed another small increase in the net speculative holding across the reporting period, taking it to 198,670 lots (+6,405 lots). This shows how the appetite remains positive, though with most of the new buying coming from the shorter-term specs any move is likely to be volatile with the potential for corrections. The market consolidated ahead of 27c as we moved through into the early afternoon, though there was no sign of what was to follow as the arrival of US specs drew some long liquidation and a sharp correction down to 26.70. Suddenly the market was on the back foot with few buyers found aside from some scale consumer interest, and this allowed for further weakness and another dip to 26.50. Given the market weakness the Oct’23/March’24 spread was holding up well as we head into the final week, the differential sitting either side of -0.25 points as March bore the bulk of the selling. The market continued near to the lows as we reached the end of the day with newswires suddenly talking of a large delivery being bearish and forgetting all the bullish headline of recent weeks. With the market at 2 week lows the March’24 settlement was made at 26.58, concluding a negative showing which will give the longs some food for thought.

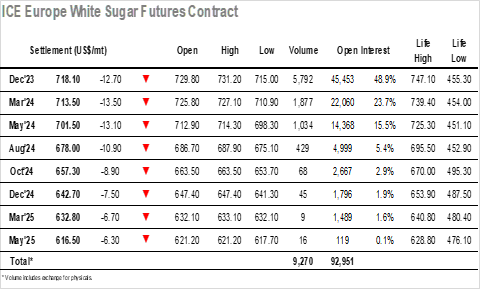

The market quickly fell back this morning to sit quietly in the upper $720’s basis Dec’23, continuing where we left off last week with consolidation remaining the trend since making contract highs back on 15th September. There were few signs that it would be anything other than a mundane session as we continued to track sideways, though the pattern broke early in the afternoon as long liquidation from US based specs into the No.11 sent prices tumbling. Our own volume remained moderate however the white premium values ensured that values tumbled all the way to $715.00, though through the flat price losses the March/March’23 widened by a couple of dollars and was trading up around $127.00. Spreads meanwhile saw some weakness as the selling focussed to the front of the board, Dec’23/March’24 trading down to $3.70 intra-day while March/May’24 touched $11.80. There was some consumer interest uncovered at the lower levels which enabled the market to remain a few dollars away from the lows during the last two hours, further widening March/March’23 towards $129.00. Some pre-close selling sent Dec’23 back slightly with settlement made at $718.10, by no means critical for the charts but bringing the congestion in the $710/$704 area ahead of the old contract highs back into view.